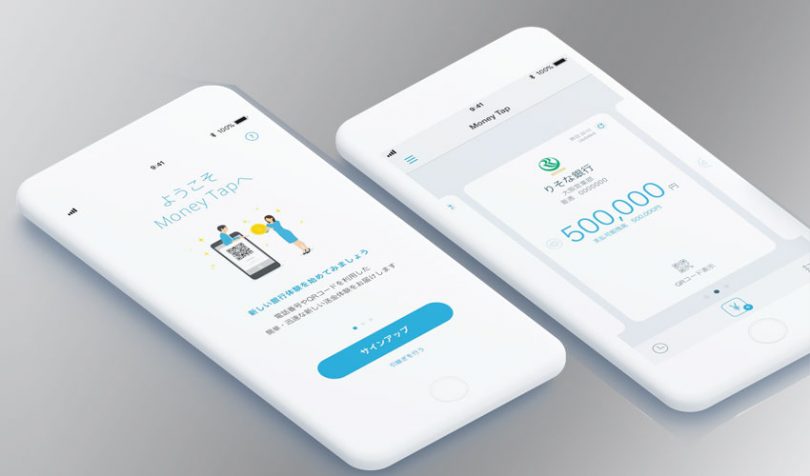

Today Japan’s SBI Holdings announced that the Money Tap blockchain payments app has incorporated into Money Tap Limited. The app launched in October last year enabling bank to bank payments by scanning a QR code. Previously it involved a consortium of sixty Japanese banks led by SBI Ripple Asia, a joint venture between SBI (60%) and Ripple (40%). By incorporating Money Tap, the aim is to provide new services faster.

According to the Nikkei Review, the company is initially a 100% SBI subsidiary with the aim of getting investment from banks to be announced shortly. But for now, SBI can provide financing to push the initiative forward.

The Money Tap app enables both domestic and foreign payments. The advantage for domestic bank payments is they can be made 24/7 rather than just during banking hours which is the current norm in Japan.

The application launched six months ago with Shumishin SBI Net Bank, Suruga Bank, and Resona Bank participating.

As for any conventional transfer, the bank account of the recipient is needed. However, it’s also possible to use a mobile phone number and QR code if the recipient has the app because they can set their default bank account for receiving funds. The app also uses fingerprint biometrics to balance user experience and security.

The system uses Ripple’s xCurrent protocol, which is the messaging part of Ripple’s technology. Hence it doesn’t currently use XRP for settlement. In today’s announcement, SBI clarified that it uses Ripple’s “RC Cloud 2.0 that handles domestic exchange centrally”.

According to the SBI Ripple Asia website it states (via Google Translate) that it’s “a cloud system that connects domestic banks participating in the Forex / Forex consolidation consortium with foreign banks that have introduced Ripple Solution. We designed and developed the system to reduce the burden of system modifications at domestic banks and to introduce Ripple Solution. We plan to develop new applications on RC Cloud in the future, and plan to use them to improve bank customer service.”

SBI has multiple blockchain initiatives. It’s an investor in enterprise blockchain company R3 and is piloting an S coin virtual currency. There are multiple Japanese virtual currency projects, with J coin the highest profile. SBI owns the exchange SBI Virtual Currencies which is live. However, the full-scale exchange platform was expected to launch this month but has been delayed until July because of regulatory hurdles.