Yesterday Japan’s SBI announced that it plans to add seven new banks for MoneyTap, the blockchain remittance network. The app launched in March and the latest additions brings the total number of investors to twenty. Separately, Mizuho announced the addition of seven banks to its J-Coin project.

The MoneyTap project was originally an initiative from SBI Ripple Asia, the joint venture owned 60% by Japanese finance conglomerate SBI and 40% by Ripple. At incorporation MoneyTap was a subsidiary of SBI Holdings, but other banks have now bought shares. MoneyTap uses Ripple’s xCurrent protocol which handles digital messaging and initially does not use XRP.

One of SBI’s subsidiaries has also created an API connection into the system.

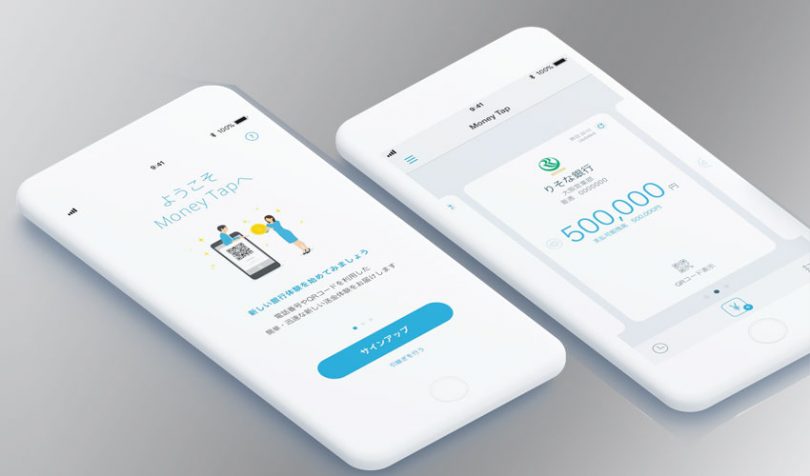

In Japan, interbank transfers can only be made during banking hours. So MoneyTap enables an alternative messaging route enabling 24/7 payments using a user-friendly mobile app.

The new banks are Ashiga Bank, Shimane Bank, Chikubo Bank, Toho Bank, Towa Bank, Fukushima Bank, and one un-named bank. They join SBI Holdings, Keiyo Bank, Atago Bank, Kiraboshi Bank, Sanin Joint Bank, Shiga Bank, Shimizu Bank, Shinsei Bank, Sumishin SBI Internet Bank, Suruga Bank, Seven Bank, Hiroshima Bank , Fukui Bank, and Hokuriku Bank.

J-coin

Mizuho’s J-coin is a digital payments tool which now has 57 member banks. In addition to person-to-person transfers it is also used for in-store payments to replace cash. It is not a cryptocurrency and the system does not use blockchain.

The latest additions to J-coin are Tohoku Bank, 77 Bank, Daito Bank, Shinhan Bank Japan, Fukui Bank, Nanto Bank and Oita Bank.

Today 80% of retail payments in Japan are made in cash. J-coin is part of an initiative to reduce that figure, but social networking giant Line has a head start in this department. Like WeChat in China with its successful WePay solution, Line is leveraging it’s existing social network for payments. And Facebook plans to do the same with Calibra.