Last week, Japanese bank SBI Holdings released details of 13 banks who have invested in MoneyTap, SBI’s blockchain based transfer app. MoneyTap was launched in 2018 as a project from SBI Ripple Asia, a joint venture between SBI (60%) and Ripple (40%) claiming it had 60 Japanese banks signed up.n

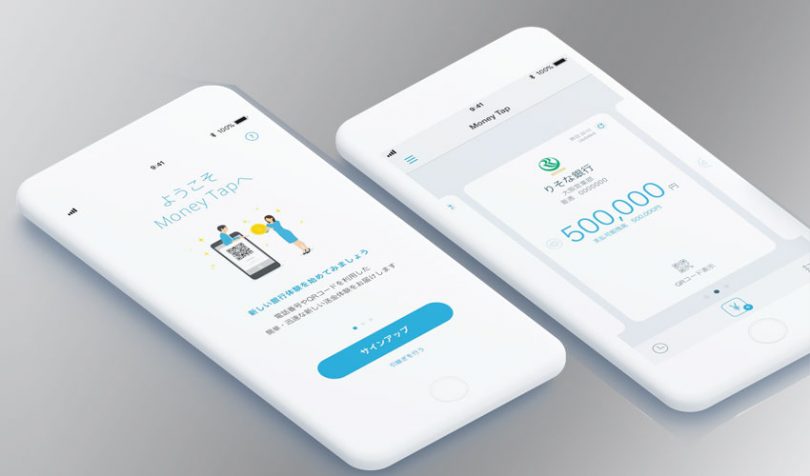

The app provides a secure platform for money transfer based on distributed ledger technology (DLT). Payments can be made either within Japan or internationally. The system uses Ripple’s xCurrent protocol, which is the messaging part of Ripple’s technology.

In Japan, conventional bank transfers can only be made during banking hours. MoneyTap’s 24/7 availability is a key advantage in the market. It also uses QR codes and fingerprint biometrics to combine secure payments and positive user experience.

Just last month, SBI announced it was incorporating the app as MoneyTap Co. Ltd. to speed up development of new services. At the time, the company was a 100% SBI subsidiary. Last week’s announcement states it now holds a 93.5% stake, with investments from mostly regional Japanese banks. SBI Group is seeking additional financial institutions as investors but plans to retain a majority stake.

The investors are Ehime Bank, Kiraboshi Bank, Keiyo Bank, Sanin Joint Bank, Shiga Bank, Shimizu Bank, Shinsei Bank, Sumishin SBI Net Bank, Suruga Bank, Seven Bank, Hiroshima Bank, Fukui Bank and Hokuriku Bank.

SBI’s release states that these investors will “participate in management as shareholders” going forward (via Google Translate).

Sumishin SBI Net Bank and Suruga Bank are two of the three firms which were live on MoneyTap upon release. The former was founded in 2007 between SBI and Japan’s largest trust bank, Sumitomo Mitsumi Trust. It focuses on internet banking and has participated in various blockchain-related activities.

Shinsei Bank, one of Japan’s Nikkei 225 companies, has previously partnered with blockchain startup ConsenSys to work on fintech projects. The firm has an international focus with English language online banking and late branch opening hours. Its assets were ¥9,456.6 bn ($85 billion) as of March 2018.