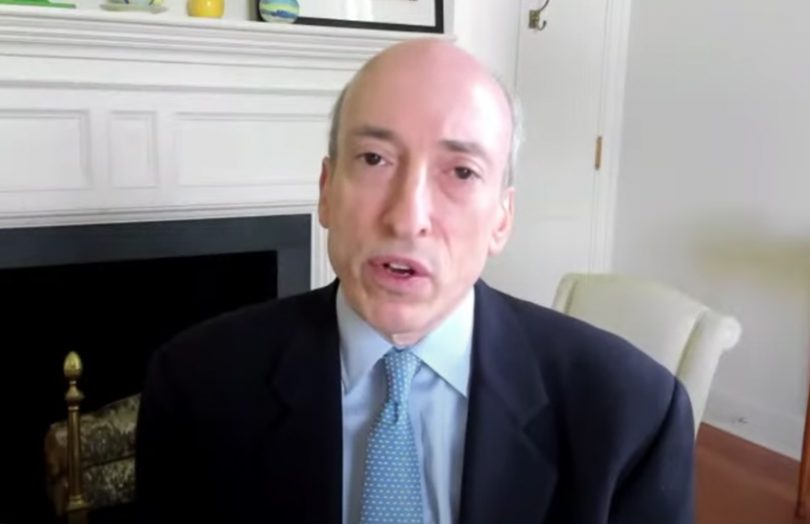

Gary Gensler, the new Chair of the U.S. Securities and Exchange Commission (SEC), asked Congress to consider greater regulation of cryptocurrency exchanges. His comments came in response to questions from Congressman Patrick McHenry, who asked what steps can be taken to provide greater regulatory clarity to enable a vibrant digital asset marketplace.

Gensler noted that the crypto-asset sector is now almost $2 trillion in market capitalization. “I think it’s only Congress that could really address it. It would be good to consider – you asked my thoughts – to consider whether to bring greater investor protection to the crypto exchanges,” said Gensler.

“Because right now the exchanges trading in these crypto-assets do not have a regulatory framework, either at the SEC or our sister agency the Commodity Futures Trading Commission.”

He continued, “That could instill greater confidence. Right now, there’s not a market regulator around these crypto exchanges, and thus there’s not protection against fraud or manipulation.”

Gensler was talking during a hearing of the House Committee on Financial Services about GameStop and retail investors.

In March, McHenry introduced a bill to create a digital asset working group with joint participation from the SEC and CFTC. So far, the bill has passed through Congress and is before the Senate.

It requires the creation of a working group within 90 days which would involve representatives from a variety of areas such as regulated entities, fintechs and academics. The group would deliver a report within a year that would provide recommendations about improving digital asset markets, standards for custody and other areas, and best practices to reduce fraud, improve investor protection, and help with compliance.

Meanwhile, earlier this week, Treasury Secretary Janet Yellen alluded to cross agency collaboration. She said, “while there are several agencies that arguably have some ability to address this through regulation, I frankly don’t think we have a framework in the United States that is quite up to the task of putting in place a regulatory framework that we need in the future. I think that’s a topic that’s well worth addressing.”

Previously Brian Brooks from the Office of the Comptroller of the Currency (OCC) collaborated with the SEC over stablecoins.