This week several digital asset bills were debated in the U.S. Congress. One that goes to the heart of the very nature of crypto and permissionless blockchains is the “Keep your Coins Act”, which aims to prevent the government from restricting self hosted wallets. While the Act progressed to the next stage yesterday, it is yet another issue that divides along party lines.

The Democrats see self hosted wallets as aiding tax evaders, money launderers, drug traffickers and other criminals. Republicans believe self custody preserves basic freedoms in a digital world.

The Republican view on self hosted wallets

“You’re still permitted to have a safe deposit box. You’re still permitted to have a safe at home with your valuables,” said the Chair of the U.S. House Financial Services Committee, Patrick McHenry. “What Mr Davidson sees is that the digital format still needs those protections.”

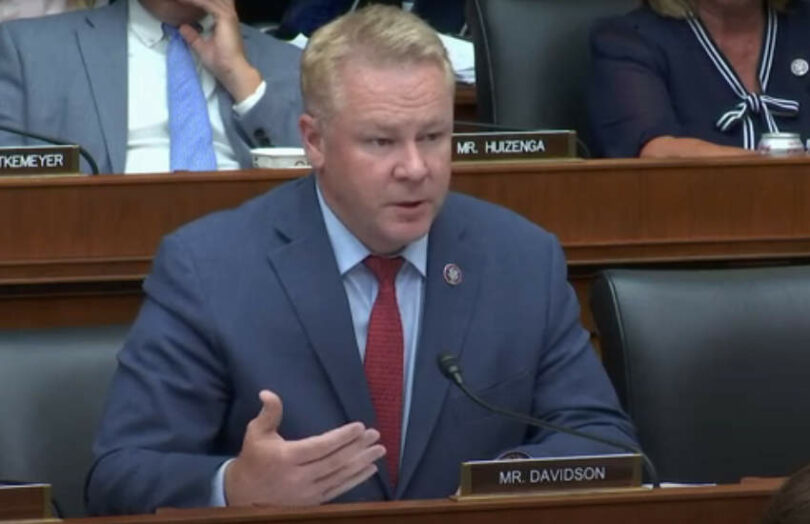

Congressman Davidson, who introduced the Bill, noted efforts by former Treasury Secretary Mnuchin to limit self custody as well as steps afoot by FinCEN. He also observed that looking after your own private keys is risky and most people will not choose that route. But nonetheless it should be defended.

He pointed to the Canadian COVID unrest and Prime Minister Trudeau blocking trucker bank accounts and requesting digital asset custodians to freeze assets.

Representative Rose noted that intermediaries “have become de facto information collectors on behalf of the federal government. At what point should we feel that our financial system has overstepped its boundaries? I believe it already has.”

He noted that Chainalysis estimates that less than 1% of transactions are illicit. “Why do we need to punish all Americans by arguing to take away their property rights when less than one percent of transactions correspond to illicit activity?” he asked.

What wasn’t mentioned was the statistics for cash. Some estimate that up to a third of U.S. cash is held by criminals and tax cheats.

Democrats equate self custody with criminal activity

Representative Sherman (Democrat) compared self hosted wallets to bearer bonds which were banned in the U.S. in the 1980s.

“On the one hand, he (Davidson) says there’s going to be monitoring because they’ll catch you on the onramps and the offramps,” he said. “And on the other hand, he glorifies the idea of being completely secret from the U.S. government. I feel this Bill will achieve that latter approach.” He clarified that as crypto can be used to buy things, you don’t have to go through the onramps and offramps.

“They’re betting on the idea that this law evasion, tax evasion tool will catch on. It will be a currency. It will be anonymous. And the only people who will pay taxes are those that work for wages.”

He added, “These unhosted wallets will be the perfect way to make illegal campaign donations without the recipient of those contributions knowing.”

Other Democrats, including ranking member Waters echoed the same sentiments. “In some ways these bits of software are not much different than your own wallet sitting in your purse or briefcase,” she said. “But these wallets can also store and instantly transfer tens of millions of dollars.”

Which way is the EU headed?

A similar debate took place in the European Union, and so far self hosted wallets have not been entirely outlawed. But they have some restrictions. P2P payments are free from anti money laundering (AML) ‘travel rule’ procedures. But they are required for any transaction above €1000 between a self hosted wallet and an intermediary.

The European Banking Authority has proposed that all transactions with self hosted wallets should be considered risky for AML purposes. That means they’d require enhanced due diligence – the highly invasive type that goes way beyond providing identity and transaction details. It asks for the source of your income, your wealth, what you do for a living and the purpose of the transaction.

Additionally, there are some question marks around stablecoin legislation. Stablecoin issuers are required to perform know your customer (KYC) procedures. Some assume that only relates to direct transactions involving stablecoin issuance or redemption. Others interpret the legislation as requiring that stablecoin issuers perform KYC for every stablecoin holder, which would include stablecoins in self hosted wallets.

In the last several years, as AML has continued to expand its reach, privacy advocates have lost ground to those that want to protect tax bases in the name of anti money laundering.