Today Japan’s second-largest bank, SMBC, announced that it will focus on web3 soulbound tokens as part of the partnership formed in July with blockchain startup Hashport.

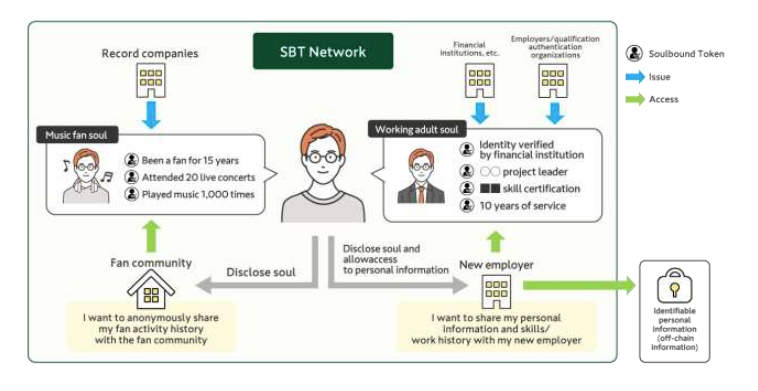

Soulbound tokens are non-fungible tokens (NFTs) that are not transferable and are associated with a person. An individual could have multiple soulbound tokens, for example, as a participant in a game with the game progress associated with the token. The person’s real-world identity doesn’t necessarily have to be associated with it. But one would include a real identity in a soulbound career token, essentially a credential. One might have another financial soulbound token that could be used for credit history.

SMBC is discussing a joint venture with HashPort to create a “safe and secure web3 economic zone”. It plans to trial soulbound tokens (SBT) with tech support from Hashprot through to March 2023. After that, it wants to progress trials to focus on career SBTs and will look at fan communities built around SBTs in association with other corporates.

For career-oriented soulbound tokens, there is some crossover with verifiable credentials and self sovereign identity. But they’re not quite the same.

Ethereum founder Vitalik Buterin is particularly interested in soulbound tokens as the foundation of a decentralized society and wrote a whitepaper on the topic.

Meanwhile, SMBC isn’t the only Japanese financial institution exploring web3. Japan’s largest bank MUFG made a significant investment into Animoca Brands’s Japanese subsidiary for NFTs and the metaverse. Nomura has created Laser Digital for its digital asset interests. And SBI has an NFT subsidiary.