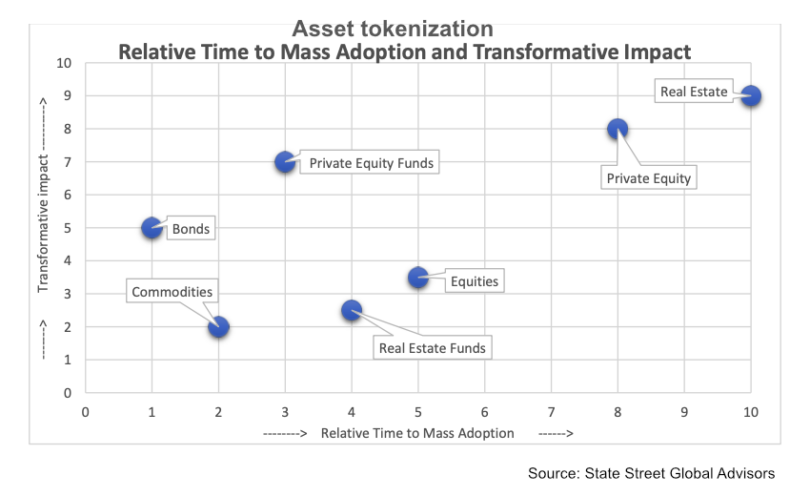

State Street Global Advisors (SSGA), the asset management arm of State Street, has published a report assessing the relative benefits of tokenization for different asset classes. SSGA has $4.4 trillion in assets under management.

It’s bullish on the concept of tokenization, noting that it can make markets “faster, cheaper, more transparent and more accessible.” However, it argues it will take time to realise the full benefits because it requires the creation of an entire ecosystem.

That build out will itself address many of the current barriers. Others frictions will fall away, including legal issues and bureaucracies such as old fashioned land registries.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.