Today the SWIAT blockchain announced that four European IT companies will become validators on its permissioned network for digital assets. The consultants are Germany’s adesso, GFT, and think tank Business Solutions as well as France’s Sopra Steria.

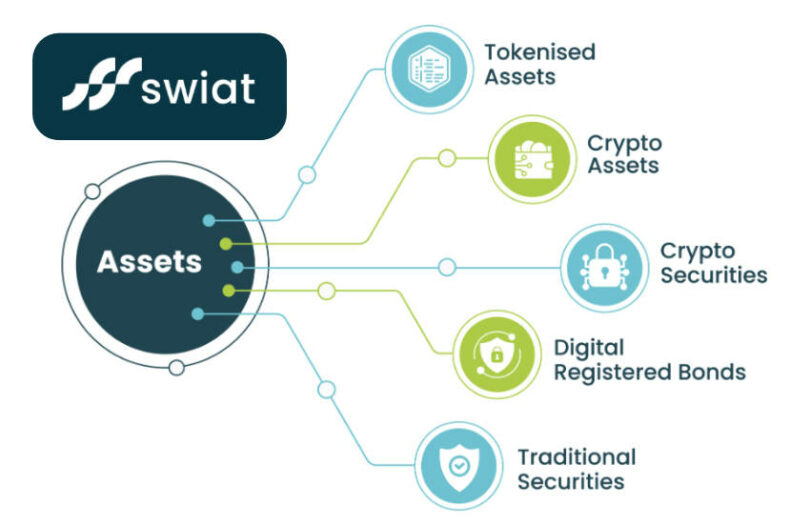

DekaBank provides asset management and capital market solutions to Germany’s savings banks. With a vision of a future tokenized world, it founded SWIAT to become a decentralized financial market infrastructure targeting banks and financial institutions for the settlement of tokenized digital assets. Earlier this year it announced the addition of new investors. These include LBBW, Standard Chartered and software firm Comyno.

Adding more validators provides several benefits. Decentralization should enhance the security of the system given there are more nodes operated by different parties. This also improves the network’s resilience if other nodes go offline.

If the validators are consultants, they in turn can bring their clients on board and develop additional solutions. That’s kind of an institutional version of the iPhone app store’s flywheel network effect.

“SWIAT has set itself the goal of establishing an international settlement standard for the issuance of digital assets together with global financial institutions,” said SWIAT’s CCO Timo Reinschmidt articulated SWIAT’s big-picture vision.

“Together with our partners in this network, we will now press ahead with gaining new customers and partners on the global financial markets.”

He confirmed that some of the consultants plan to incorporate SWIAT into their own digital solutions. And others might co-develop solutions on the network that is powered by enterprise Ethereum.

SWIAT also put a figure on its expectations for Europe: “the decentralised financial market will grow more than 60 percent per year (CAGR) to more than €3 trillion by 2030.”

Other global predictions include $16 trillion from BCG, and $28 trillion from EY.

Multiple solutions have similar aims to SWIAT, with the Regulated Liability Network perhaps the closest. Additionally, there’s the BIS vision of a Unified Ledger. Fnality and Partior are more focused on the payment angle.