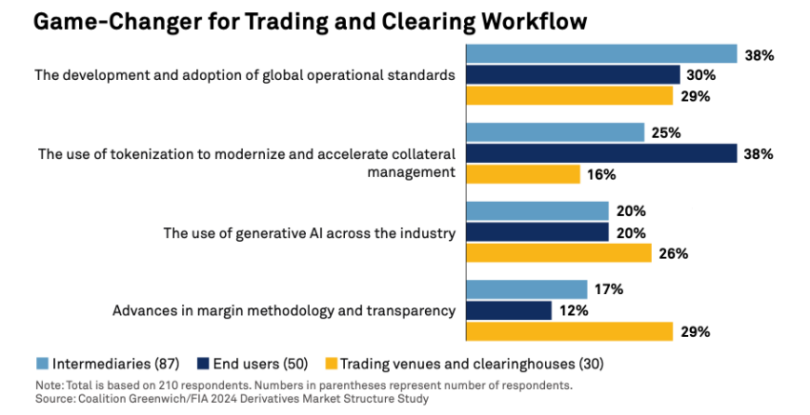

A recent survey by Coalition Greenwich for the Futures Industry Association (FIA) found that the derivatives sector considers the use of tokenization to modernize collateral management more important than generative AI. The question related to derivatives trading and clearing workflow. These results contrast with some other recent surveys in which AI outstripped DLT.

However, the results depended on who was asked. Overall, the adoption of global standards was regarded as the most important. But end users considered tokenization of collateral management as the most important (38%). End users include asset managers and hedge funds who are embracing DLT. While tokenization was the second most important driver for intermediaries (likely responding to client demand), it was considered the least important for trading venues and clearinghouses.

The workflow question was asked in the context of ‘the future’ rather than immediate benefits. When intermediaries were asked about changes required to grow their business, ‘breakthrough technologies’ didn’t rank particularly high. However, the top pain points were improving netting followed by collateral management enhancements.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.