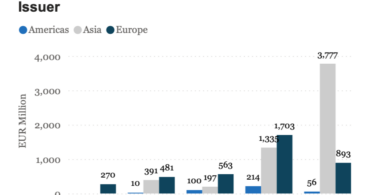

The Association for Financial Markets in Europe (AFME) published its semiannual progress report on the adoption of DLT in capital...

Tokenized bonds

Numerous major banks and capital markets firms have launched DLT platforms for tokenized bonds.

These digital bonds are issued natively on the blockchain, there is no other version of the bond. So far, most have been issued on enterprise blockchains, but a reasonable number were launched on public blockchains.

Key benefits include efficiencies that lower issuance costs, enabling smaller bond tranches and denominations. Plus, blockchain supports atomic settlement which eliminates counterparty risk. Payment doesn't always have to be instant. The advantage of automation enabled by DLT is the payment can be agreed and automated for a specific time in the future.

Examples of banks with issuance platforms for tokenized bonds include Societe General Forge, Goldman Sachs, HSBC, UBS and BNP Paribas. Stock exchanges and central securities depositories (CSDs) are also involved. The SIX Digital Exchange was the first to launch a regulated digital CSD and secondary market. It is also home to the largest bond issuance so far, a CHF 375m UBS bond.

SBI to issue digital bond targeting retail investors with XRP perks

SBI Holdings announced plans to issue a ¥10 billion ($64.6m) unsecured digital bond, SBI START bonds, targeting consumers. The issuance...

Bank of Greece simulates sovereign digital bond lifecycle with SWIAT

The Bank of Greece has completed a simulated issuance of a sovereign digital bond on the distributed ledger platform operated by SWIAT...