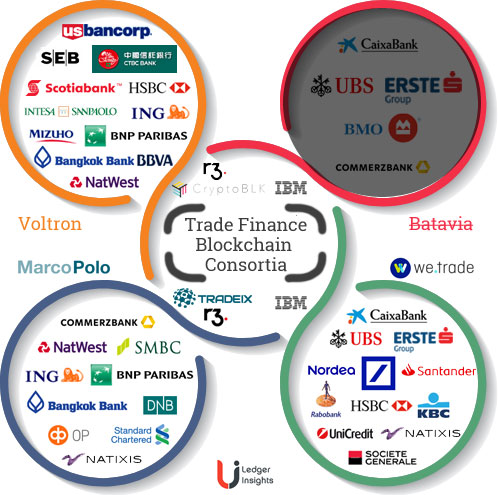

Today we.trade, the nine bank trade finance consortium confirmed joining forces with some former Batavia consortium banks, as previously reported. Both consortia share IBM as a common technology partner. In early July, we.trade was the first trade finance blockchain to go live. Three of Batavia’s five banks, CaixaBank, Erste Group and UBS, will join we.trade as equal shareholders and the country coverage increases from eleven to thirteen.

Commerzbank is also part of the R3/TradeIX Marco Polo consortium and will not be joining we.trade, and nor will Bank of Montreal.

Rationale

Marleen Wapenaar, we.trade product owner for Rabobank and a we.trade Alternate Board Director, explained the rationale behind the consolidation: “In the trade ecosystem we’d like as many banks as possible so we can service as many customers as possible.” To take advantage of we.trade, both the buyer and seller have to bank with a we.trade member. Wapenaar continued re Batavia: “They have more or less the same vision, so we thought it would be handy to shake hands and do it together.”

And we.trade is actively looking to enlarge the member pool of banks further. The expanded group will continue to target the European SME sector. However, this is the initial scope, and there are plans to target corporate customers next year. Wapenaar described the approach as similar to a fintech, starting small with an agile approach and then scaling up. So right now the volumes are deliberately being kept low.

“we.trade welcomes CaixaBank, Erste Group and UBS as shareholders and users. This confirms the previously announced roadmap of we.trade and keeps us on track with our strategy of expanding our global coverage network over the coming quarters with banking and non-banking partners,” said Roberto Mancone, Chief Operating Officer, we.trade.

Batavia had a broader target market and a wider set of products. We.trade’s working group will be exploring which of Batavia’s functionalities are worthwhile adding to we.trade.

Second consortium consolidation

This is the second trade finance consortium reshuffle in a matter of weeks. Two weeks ago a commodity trade finance group called komgo was formed. In that case, the technology came from ING, ABN Amro, and Societe Generale and their Easy Trading Connect platform. The additional shareholders are also part of the VAKT project, so the group has nine banks as well as energy companies such as Shell.

About we.trade

We.trade currently targets European SME to SME trade. Buyers can purchase a ‘Bank Payment Undertaking’ (BPU) which guarantees payment by the importer’s bank to the exporter. On the supplier side, they can buy invoice discounting to enable them to get payment earlier (based on BPU or not). Each bank chooses which products they wish to offer because the client needs and regulations might be different in each country.

The platform also includes a social database where SMEs can find potential trading parties. The existing banks are: Deutsche Bank, HSBC, KBC, Natixis, Nordea, Rabobank, Santander, Societe Generale and UniCredit. A previous article covered the we.trade consortium in depth.

The blockchain learning experience from a bank’s perspective

Wapenaar shared the takeaways from Rabobank’s involvement so far. She observed: “If you have a common vision or a common goal, you can fix every problem you have.”

“I think it was easier than I expected. It is really nice to work together. Everybody is still a bank, so everybody has more or less the same background. So the people you work with are also product managers from the other banks.” As a result, there’s a shared vision. Most of the banks have the same issues, such as legacy systems or the availability of resources.

In Wapenaar’s opinion, we.trade managed to go live in quite a short period. Because there are so many banks involved, different banks can take on particular tasks, thereby spreading the load. For example, the rule book was done jointly by a couple of consortium banks. The same applies to many different working groups.

And because fewer resources are needed, the costs are spread and end up being lower than for an equivalent single company project. Also, there may be some areas more than others where a bank has people available or subject matter experts.

Wapenaar also doesn’t believe the technology aspect is the hardest part. IBM handled the blockchain aspect. But the banks still have to implement the bank backend aspect. For example, the smart contract triggers a payment via SWIFT or SEPA, new products like BPU needed adding, and of course security.

After the initial launch, they gathered client feedback across all the different European countries. The client response was very positive. One aspect that was surprising was that the input was more or less the same across the banks and regions. In general, clients want to trade in an easy and cost-efficient way, have access to finance, and lower their risk.

Blockchain downsides

There weren’t any major negatives Wapenaar could think of. There are some areas you can’t share between companies because of competition laws, like pricing.

Concerning the sort of people suited to working on a consortium project, they need to be flexible, energetic and enjoy working with different people and cultures.

The governance issues mean things take a little longer. For example, when we.trade transitioned from a consortium to the we.trade company. It just requires good communication, but that wasn’t a significant issue.

What’s next

The top priority is expanding the network of banks.

More we.trade platform enhancements will be coming out in October including email notifications and track and trace of goods. When the tracker shows that goods have been delivered, then a smart contract can trigger a payment.

Wapenaar’s ‘easier than expected’ observation is becoming a theme for consortia that are in production or nearing it. It seems the idea of working with the competition is scary before a decision is made. But once a company has committed, it’s not that hard at all.