Following reports from a Scottish newspaper about the UK’s exploration of a central bank digital currency (CBDC) dubbed “Britcoin”, the UK Chancellor Rishi Sunak has since responded, insisting that a CBDC would not replace cash.

“Any potential UK CBDC would exist as a complement to cash and bank deposits, and not a replacement. We know that cash remains vital for millions of people and are fully committed to ensuring people across the UK can continue to access it,” said Sunak in a Linkedin post.

Some cash features are beneficial, such as its physical nature means it does not rely on any technical infrastructure. Cash can also be held anonymously, ensuring privacy in payment transactions.

For some countries such as Sweden, a potential CBDC aims to address the fast disappearance of cash. The rapid development of e-commerce, and the increased use of electronic payments due to the pandemic, have accelerated the shift toward digital payment habits.

While Sunak has assured that the CBDC is not intended to reduce cash usage, a side effect of the move to digital payment systems is a decrease in cash circulation.

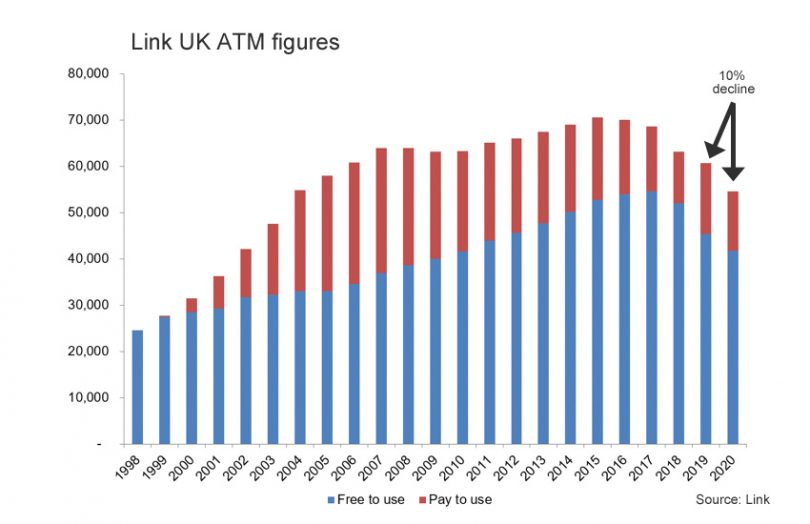

Payment systems work on network effects, so the less cash that is used, the fewer ATMs in operation, and thus the less cash that is supported.

The declining number of ATMs is already an issue in the UK. According to a survey by Link, 60,662 ATMs were in operation in 2019, falling to 54,574 in 2020, a 10% decline in just one year.

Currently, the UK is exploring emerging forms of digital money through surveys and discussion papers, one of which was published by the Bank of England in June.

“We want to make sure the UK is at the cutting edge of innovation and technology in financial services, so it’s right that we explore the potential role of CBDCs to understand the wide-ranging opportunities and challenges they could bring,” says Sunak.

Meanwhile, across the pond, the U.S. Congress is also weighing up the need for a CBDC digital dollar. Key topics debated include clarifying the purpose of CBDCs for domestic and cross border usage and privacy issues.