Western Union confirmed it plans to launch its own stablecoin, the U.S. Dollar Payment Token (USDPT) on the Solana blockchain in the first half of 2026. It has partnered with US chartered trust bank Anchorage Digital for the issuance. It is also formalizing its on and off-ramp capabilities by launching its Digital Asset Network.

“Western Union’s USDPT will allow us to own the economics linked to stablecoins,” said Devin McGranahan, President and CEO of Western Union. “Separately, we are excited to announce our Digital Asset Network, a solution for the last mile of the crypto journey by partnering with wallets and wallet providers to provide customers with seamless access to cash off-ramps for digital assets by leveraging our global network.”

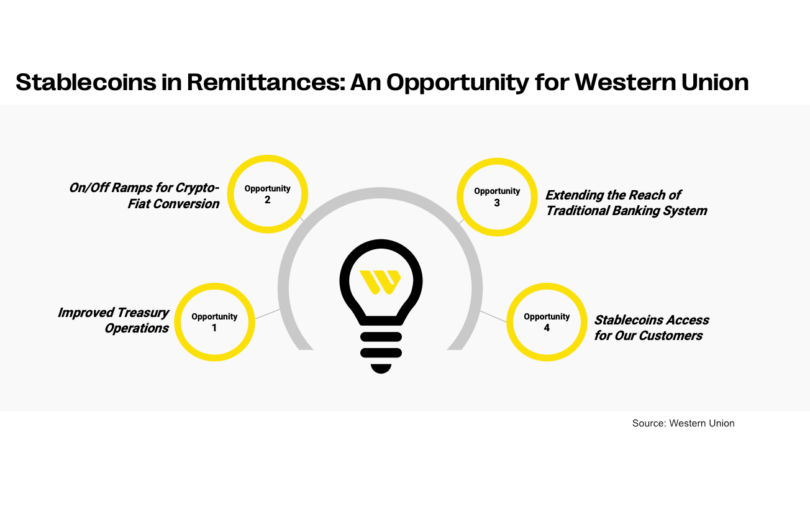

During an August Bloomberg interview and last week’s quarterly earnings call, McGranahan positioned stablecoins as an opportunity for Western Union. The company plans to offer dollar stablecoin accounts, similar to Stripe’s, except that Stripe mainly appeals to SMEs whereas Western Union has massive consumer reach in the emerging markets where dollar stablecoins are appealing. “In many parts of the world, being able to hold a U.S. dollar-denominated asset has real value, as inflation and currency devaluation can rapidly erode an individual’s purchasing power,” he said last week.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.