Galileo Platforms is building a major blockchain application that aims at replacing policy administration systems in the Asian market. There’s a separate article covering the business. CIO Mark Wales spoke about their technical approach:

The choice of Ethereum or Quorum versus Hyperledger is always an interesting one. We’ve got a lot built. The insurance model for retail insurance is a big build. These are big legacy systems that we’re looking to challenge, quite honestly.

We started coding almost 18 months ago. And at that time, Quorum didn’t exist. We were coding on native Ethereum. But we felt that someone would solve the encryption and consensus problems that we needed to solve. And we were right. Thank you, JP Morgan, for doing so.

Ethereum Robustness

So our judgment on that firstly was really good. But at that time, Hyperledger wasn’t even in beta. It was still a long way off getting to that particular point. As was R3 – that was still very early days for them. So part of that decision was, this was the robust blockchain – and it remains it today.

The one thing which we like about our choice of platform is that it has been running since 2015 in a real public blockchain environment. Its scalability and other issues are well understood. It stood the test of time of load and other things, and that’s something which we think is incredibly valuable. Yes, we’re still watching. And by the way, in that timeframe, we’ve built out a really big model.

Our model at the moment is over eighty smart contracts, so it’s a big build, and we’ve got more to come. We’ll probably add another 40 or 50 before we finish that particular model. So, we needed an environment that could actually stand that sort of complexity. And we thought Ethereum gave that. It was certainly a lot more mature at that time, and I think it remains a lot more mature today.

It has a far larger development community than any of the other blockchains. The number of people developing solutions on the public network as well as Quorum is far greater.

We’re not silly as well. We are going to continue to monitor what some of these other solutions are doing, and the other thing which I’m comforted of is that there will be mechanisms that will enable us to integrate across platforms in the future should we have to. I’m not particularly concerned about that, but one thing I will say is I am quite confident about the choices we’ve made so far. I think they’ve been good choices.

Blockchain and the internet parallel

Everyone keeps drawing the parallel between blockchain and the internet. And the internet, when it first started, there was lots of intranets and extranets… But if we take a view as well, that this (blockchain) also evolves towards the public network in the way that the internet evolved to everyone using public networks, then that actually puts Ethereum in a very strong space.

If we can do faster consensus mechanisms and encryption on Ethereum, and they’re looking at those particular issues, with the Casper release coming out, and if there’s zero-knowledge proofs, etc, then to be able to move away from private networks onto very secure public networks is a long-term possibility for this industry.

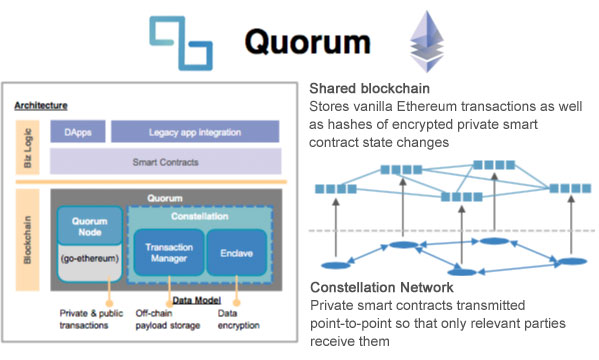

Quorum

So we’re using Quorum symmetric encryption so that only the parties to the transactions are able to access the transactions. And secondly, it gives us faster consensus. So we’re using rafting as our consensus mechanism which means we build blocks sub-second. That means we’ve achieved the real-time transaction levels that we’re looking for.

Part of the strength of Quorum … is your node only contains your information. The way Quorum unpacks the transactions and sends them directly to the counterparties can achieve that exact outcome.

And by the way, that has some very strong benefit for us as well. In some of the jurisdictions that we need to work in – the likes of Malaysia, China, Indonesia – they have very strong regulatory requirements around data residency, so the ability for the companies to keep their nodes in-country, and only have that data shared between the counterparties within that country is important. And that’s one of the things, the sorts of processes that Quorum provides as an example is really key to us being able to meet that regulatory requirement.

Beyond the blockchain

We’re not just building the functionality for the blockchain; we’re building a whole environment for the insurer and the distributor on the nodes. So, a no SQL database that will contain all of their transactions and the whole history of those transactions, so they can quickly access them through a frontend that we’re building. We call that ‘reflector’ which enables them to do inquiries across all of their client base, all of their policy base, etc.

It also gives them the ability to do analytics across all of the policies that they’re holding on that environment. We’ve also built out an oracle framework so that insurers can have a quotation oracle, a claims oracle that can automatically triage claims, payment oracles to integrate into various payment systems, etc.