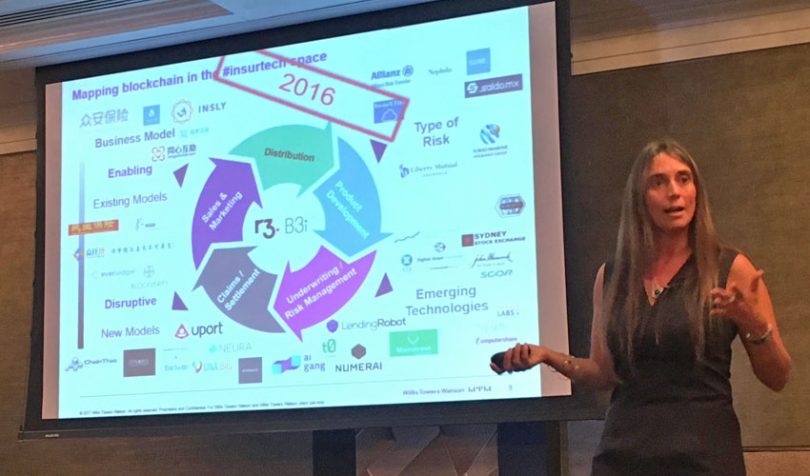

In advance of the Blockchain for Insurance conference in London on June 18-19th, we interviewed blockchain and insurance innovation expert Magdalena Ramada Sarasola, InsurTech Innovation Leader at Willis Towers Watson (WTW).

“Blockchain was originally not meant for enterprises,” says WTW’s Magdalena Ramada Sarasola. “It was meant for peer-to-peer value transfer. So every time I come across enterprise applications, I’m a bit sceptical, given many of them are not leveraging the right attributes of blockchain technology and are trying to force its use in areas that do not make sense.”

She continued: “Some of them though, use the same principles that enabled blockchain to become a decentralized P2P value transfer platform, to enable B2B enterprise ecosystems, which is a great way of applying blockchain in the context of complex enterprise value chains. In these ecosystems anonymity is less of a problem, but there’s a need to address conflicts of interest, lack of trust or transparency, and to have one synchronized – as opposed to many reconciled – ledger(s). A great example of this is what B3i or R3 are doing. They are applying the concept of peer-to-peer decentralization to a network of enterprises. ”

Ramada thinks B3i’s selection of R3’s Corda technology was the right decision, they have a strong technical team and she likes the ecosystem approach, which allows fruitful interaction with both enterprise experts and the open source community. “B3i has strategically redefined its role as becoming the ones that provide the infrastructure, say the ‘iOS,’ on top of which the insurance industry can build blockchain applications. They manage the network’s permissions and authentication of players and have built the app store where they’re going to deploy some apps themselves, but the rest of the apps should be built by the industry.”

B3i started in reinsurance post-placement and now is moving into other reinsurance value chain areas, as well as into commercial insurance applications.

At the same time, Ramada commented that a consortium is, “for obvious reasons, always going to move slower than a single entity”. And yet, consortia are needed to build the infrastructure of industry wide utilities that can advance the industry as a whole and foster common standards.

When it came to the other big enterprise consortia, Ramada didn’t pull her punches. “I have seen less traction there, but most of them are younger ventures and in a different type of ecosystem, even from a regulatory environment perspective, so that they shouldn’t be compared at this stage.”

She continued: “In general both in the public and private blockchain context it is very difficult at this stage to bet on a single ecosystem and predict which approach is going to prevail. They are all at an experimental stage and momentum depends a lot of the explicit backing and resource commitment of incumbents.”

Ramada mentioned the example of a subrogation industry utility. The first conversations about a subrogation project in the US happened before any US insurance consortia existed. Individual carriers were interested and some had even coded a prototype on their own. But those efforts only make sense if you can rally multiple carriers to test it and hence why it was thought that using a consortium structure to advance it would make sense.

The RiskStream Collaboration (formerly RiskBlock), is an international insurtech consortium founded by the U.S. based The Institutes. It had a subrogation project which was put on the backburner to focus on its first two solutions. The subrogation decision was made by its Advisory Board of insurers and confirmed to Ledger Insights by Nationwide seven months ago. However, an announcement about it moving forward is expected in the coming months.

The startup space

Ramada also monitors startups, and the two she’s paying the most attention to are Etherisc and Nexus Mutual which have both developed distributed insurance solutions based on the public Ethereum blockchain. Some time ago Germany’s Etherisc developed a flight delay insurance app, and more recently they’ve been working on Hurricane Guard for the Puerto Rico market with automatic payouts when certain wind speeds are recorded within the area.

But the one that has captured Ramada’s imagination is UK-based Nexus Mutual, founded by actuary Hugh Karp, formerly with Munich Re, who has created the first mutual on a blockchain. Currently, it provides protection for blockchain developers in case their smart contracts have bugs.

“The way he [Karp] overcomes not having historical data for pricing is by a staking mechanism, in which people ‘bet’ on a smart contract’s resilience. The structure really works like a mutual and the payment of claims is decided through network consensus.” said Ramada. “People joining the mutual are owners of the mutual, and they define which claims get paid and which ones don’t. So to me, although very experimental and in a niche currently, it’s one of the most tangible distributed insurance developments.”

Is disruption coming?

So comparing the startups with the incumbents what does Ramada think about disruption? “At the beginning, the very anarchic part of the space was really looking at how to bridge the risk to capital journey in a distributed and non-intermediated fashion. And that’s the blockchain native’s ecosystem vision and that’s the view of insurance or a broader risk management Nirvana. A world in which smart contracts can access distributed data vaults and identities, assess, price, pool and place risk through coded, transparent rules and without the need of an underwriter,” commented Ramada. “And most of the insurance incumbents do not believe that could become a reality.”

She continued: “Instead, how are they [incumbents] approaching blockchain technology? Well, by looking at something the technology was not necessarily meant for, which is to foster synchronization and automation among companies within a common ecosystem or value chain. And I think it’s actually okay. In the short term, it will yield some interesting use cases and results. It is enabling ecosystems of value to become more transparent and efficient. It can be used for that. It also increases awareness and has a very important educational impact. Although there are multiple other technologies that are better and more mature for synchronization and automation than blockchain.”

But for the original vision of risk to capital markets, mutualizing risk, there needs to be a lot of building blocks and plumbing. And that’s something she sees as coming from outside the insurance industry by the likes of ConsenSys or startups such as Nexus Mutual where someone has insurance expertise but is approaching it differently.

“I am not surprised that in the peer-to-peer space or the full automation of risk to capital journey, that we’re not seeing incumbent activity, because that’s an activity that incumbents have little incentives to lead,” said Ramada.

“One, it is highly disruptive of their own business models. Two, it requires a lot of investment in infrastructure that they have no incentive to build. I think it will happen regardless, and probably not for every area of risk, but for many areas of risk it will happen. But we’re still at least five or seven years away from that.”

How to handle complexity

Ledger Insights has heard arguments that some insurance automation is not viable because it’s too complex. “I think we’re seeing a lot of fragmentation of risk. And the more data you have and the more hyper granularity you have on data, the easier it is to break down complexity, to fragment risk, and to process it in a fragmented way and to price it in a fragmented way,” said Ramada.

“And I think at least for short tail risks, that complexity will be broken down.”

The side effect of having more granular data is being able to identify unattractive risks and more easily price them accordingly. In some jurisdictions, there are laws for example against using genetic information to price or restrict access to health insurance or certain products.

She observed that “in general, there’s no regulation protecting people from having to ‘volunteer’ their own data, even less if it is behavioural data. If certain governance is not developed for high-stake technologies, this may lead to parts of the population becoming uninsurable in the future.” Ramada referred to it as “the dark side of analytics” and said, “that’s a very big risk of the things we’re building taking us to a rather dystopian and unsustainable future.”

She believes that new forms of social interaction and new technologies are here to stay. Referring to the insurance discrimination issue Ramada said that “those things will happen and we will have to think about how to regulate them and govern them.” She observed that “in a world in which both risk and capital become fully fungible and do not respect geopolitical boundaries anymore, governance frameworks will need to be globally aligned or regulatory arbitrage will prevail.”