The World Federation of Exchanges (WFE) has written a letter warning of the risks of tokenized stocks. “These mimicked products do not meet the high standards which investors are used to,” said Nandini Sukumar, CEO of the WFE. The missive has been sent to the US SEC’s Crypto Task Force, the European Securities and Market Authority (ESMA) and IOSCO’s Fintech Task Force.

Several of the WFE’s criticisms of the recent swathe of tokenized stocks have strong foundations. There’s been a wave of offerings by Robinhood, Kraken, ByBit and Republic. None of them are straightforward. Some are derivatives, others are loans or wrapped stocks. They are all early iterations and will improve. Even some crypto venture firms have raised an eyebrow or two at the structure of the issuances, as discusssed below. So when the WFE voices concerns around investor protection and what happens if a platform becomes insolvent, many can see the point.

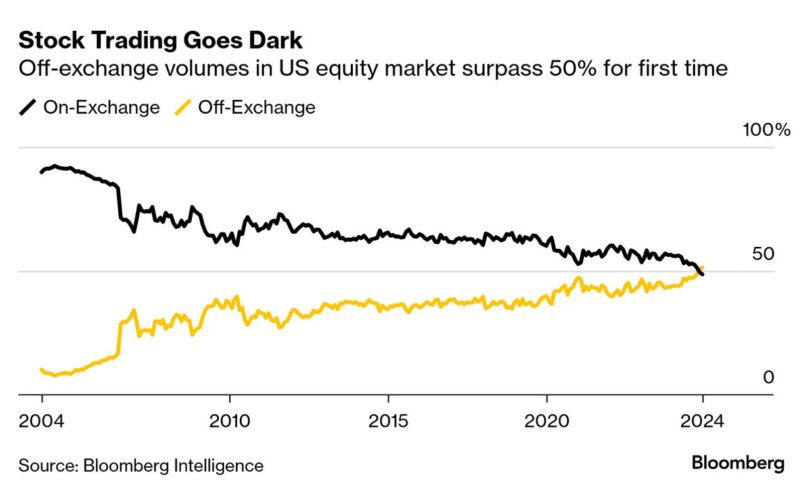

But top of the WFE’s list of concerns is liquidity fragmentation. Regulatory arbitrage is also a worry. Clearly, tokenized stocks pull trading further away from the regulated exchanges and central counterparties that the WFE represents. With the expansion of dark pools over the past several years, the exchanges’ market share already dropped below 50% in late 2024. The trading of tokenized stocks on crypto exchanges will expand that trend. So innovation is palatable to the stock exchanges, when it’s on their terms. “The WFE supports innovation, particularly when done based on exchange traded products,” said the WFE CEO. The letter clarifies that “products” means public lit markets, rather than dark pools or other off exchange trading.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.