Today French blockchain startup Sorare announced that it raised a $50 million Series A funding led by Benchmark. Other participants in the round include Accel, Reddit’s Alexis Ohanian, Gary Vaynerchuk and Barcelona striker Antoine Griezmann. The startup has now raised $60 million to date.

The company operates a fantasy football (soccer) collectible game that uses non fungible tokens (NFT), ensuring the player’s card is unique. Based on the Ethereum blockchain, the cards are tradable with a unique Christian Ronaldo card recently selling for $102,000. Sorare has signed 126 soccer clubs, including big names such as Liverpool, Paris Saint-Germain, Bayern Munich, Real Madrid and Juventus.

In the last three months, Sorare says its volumes have grown 52% per month. Back in January 2020, it was trading $60,000 worth of cards which increased to $4.2 million in January 2021.

For football clubs, these sorts of games enable them to engage with a global fanbase. The startup’s ambition is to onboard the top 20 football leagues globally.

“Sorare was born from our love for football. We’re building a gaming experience fueled by passion where fans can connect with football and a global community. On Sorare, they can truly own the game,” said Sorare CEO Nicolas Julia.

In May 2019, Sorare raised just over $500,000 in a pre-seed round that included Ethereum development house ConsenSys. Last July, it followed that up with a $4 million seed round led by e.ventures which was later extended to $10 million.

“Sitting at the intersection of fantasy football and sports collectibles, Sorare is revolutionizing the way fans across the world engage with and enjoy sports. In just a year, Sorare has built an incredible viral community and secured partnerships with more than 130 football clubs, including five European Champions,” said Andrei Brasoveanu, Partner at Accel.

Comparison with other blockchain sports collectibles

The Accel partner’s point is a strong one. Sorare went from a standing start in 2019 to where it is today.

It invites comparison with Canada’s Dapper Labs. Sorare traded $4.2 million in January, but Dapper’s NBA Top Shot has transacted more than $200 million in the last 30 days. However, almost $150 million was in the last seven days following blanket media coverage and hype.

Dapper Labs is also a lot older. It had the successful CryptoKitties game back in 2017. And it had already signed the NBA and raised major funding by the time Sorare was raising its $500,000 pre-seed round.

Dapper has no major competition in basketball, whereas Sorare has several, including Socios.com that focuses on token trading, games firm Animoca and collectibles app Fantastec. Both competitors have also signed high profile European teams and in some cases, the clubs are using multiple apps. However, recently Sorare managed to add Real Madrid which already has a deal with Fantastec’s SWAP.

Another difference is technology. Dapper had its fingers burnt with CryptoKitties when the popularity of the game in 2017 almost ground Ethereum to a halt. And gas fees used for blockchain transactions were high. As a result, Dapper decided to create a new blockchain, Flow.

Sorare is using Ethereum, which is experiencing prohibitive gas fees because of recent DeFi success. That’s bad news for the game. This is from Sorare’s FAQ’s: “In unexpected peak times like the last couple of days, we can experience issues that affect your Sorare experience. When Gas fees are high, card and ETH transfers can take up to a few days.”

A fourth difference relates to the business model. Dapper’s NBA Top Shot takes a 5% cut of all market sales. Sorare makes money on auctions of cards and nothing on secondary sales, for now.

A final point where Sorare seems to be leading relates to know your customer (KYC) compliance. Both NBA Top Shot and SoRare allow collectible purchases with credit and debit cards to hide some of cryptocurrency’s complexity from mainstream users. Dapper partnered with Circle and Sorare with Ramp. Dapper has struggled to keep up with the KYC required for withdrawals attracting complaints. On behalf of Sorare, Ramp processes the KYC in the background using open banking APIs.

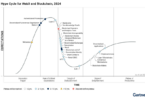

For now, the NFT sector is red hot and NFTs are looking like the next generation of fantasy sports and collectibles. For sports franchises, the upside is greater fan engagement and a new source of revenue. But there is a potential downside that might need some research. If a fan ends up losing money from trading NFT tokens, do they associate that negative experience with the sports brand?

Related story: An analysis of Dapper Lab’s NBA Top Shot

Update: Details re Sorare’s business model were updated