Crypto market intelligence company Inwara released a report into blockchain and cryptocurrency startup funding. It shows that in the first half of 2019, token offerings raised $3.39 billion, compared to more than $15 billion in the same period of 2018. By comparison, venture funding faired slightly better with $1.26 billion invested compared to $4.2 billion in the first half of 2018.

For token offerings, Inwara split the fundings into Initial Coin Offerings (ICOs), Initial Exchange Offerings (IEO) managed by crypto exchanges, and Security Token Offerings (STOs).

583 Token Offerings were launched during the first six months of 2019, of which 69% were ICOs, 21% IEOs and 10% STOs. 66 (11.3%) were in the U.S., followed by Singapore with 52, and the U.K. with 50. China was a distant fourth with 31, but it was second with IEO’s which raised significant sums.

Because of IEO’s China was by far the leading country in terms of funds raised taking a third of the $3.39 billion. The United States was a distant second with 7.6%.

But China’s Bitfinex IEO raised almost $1 billion alone, which distorted the figures. Once you remove that, China raised just over $180 million, compared to $255 million by the U.S. and $232 million by Singapore.

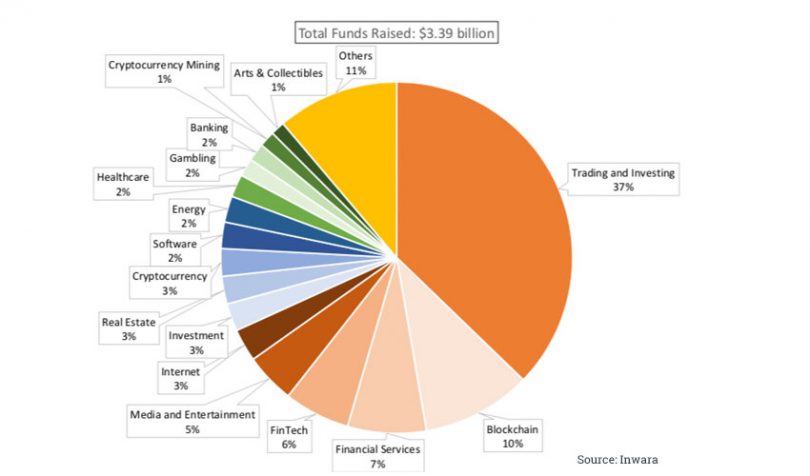

In terms of industry sectors, financial services dominated token offerings. Combining trading and investing, fintech, banking, cryptocurrency and financial services, the total figure was 55%. Blockchain technology was second taking 10% with media and entertainment next with 5%. Energy, where blockchain is seen as offering huge benefits attracted just 2%.

Inwara says that merger and acquisition deals were also down 34.6% with 47 deals in the first half of this year. The biggest was the Visa acquisition by Earthport at $305 million. Earthport has banking relationships in 87 countries. It provides services to the likes of Transferwise and helped develop Santander’s first forex app powered by Ripple. Visa was involved in a bidding battle with Mastercard.