Cambridge Centre of Alternative Finance (CCAF) released its second Global Enterprise Blockchain Benchmarking Study.

CCAF talked to more than 160 respondents and observed 67 live networks. The paper notes that a lot of the hype surrounding distributed ledger technology (DLT) has faded and corporates are considering more realistic approaches. Keith Bear, IBM’s former VP of Financial Markets (until Jan 2019) is a co-author of the report.

Networks founded by single entities rather than consortium

The most surprising takeaway is of the 67 live blockchains, the report states that a single company founded 71% of them. That compares to 22% that were consortium led. Governments established the remainder. It cites the often dominant position of the lead company. It’s worth noting that many technology companies have also initiated networks. Unquestionably consortium projects move more slowly, and many have yet to launch, which could explain the bias in part.

The report didn’t specify these examples, but high profile founder led projects include CLS in foreign exchange, the DTCC’s blockchain derivatives platform, JP Morgan’s IIN payment messaging project, Finastra’s syndicated lending network and IBM’s Food Trust.

Ledger Insight’s anecdotal observation is of several networks initiated by two partners, often a technology and business partner. However, in some cases one of the two parties may have been the initiator.

Examples include TradeLens (IBM, Maersk), Insurwave (Guardtime, EY), the Utility Settlement Coin (Clearmatics, USC), and the Energy Web Foundation (Grid Singularity, Rocky Mountain Institute).

Industries and use cases

Within the sample space of the study, about 43% of live blockchain networks were in the financial services sector. The next sector is not even close at 6% for food services and retail. The report considers supply chain tracking as a use case, and it’s the leading application at 19%. Other top use cases include trading (15%), certification (10%), trade finance (9%) and payments (7%).

For blockchain service providers, the key selling point is cost reduction, but adopters are also looking for revenue generation by introducing new products and services. A large proportion of the live blockchain networks are being used to reduce costs for participants by streamlining reconciliation (72%).

“In multiple industries, enterprise blockchains are perceived as a solution to establish common data standards across organizations, eliminate organizational silos, and facilitate record reconciliation to help improve overall efficiency and enable the creation of new services,” said Robert Wardrop, Director of CCAF.

Technology

On the technology front, Hyperledger Fabric is the most popular (48%) platform for building a blockchain network. It is followed by R3’s Corda (15%) and Coin Sciences’ MultiChain (10%) framework (SAP’s preferred protocol). For this sample set, Ethereum-based Quorum came in at just 6%, and other Ethereum implementations did not have a material presence.

(Hyperledger, R3 and Coin Sciences were mentioned in the acknowledgements, but not the Enterprise Ethereum Alliance. Had they participated perhaps they may have identified additional Ethereum projects).

While blockchain is about decentralization, the study found that 81% of the networks have a central entity overseeing the governance.

Organizations need to have the patience to get involved in blockchain. CCAF estimates that a median enterprise blockchain project takes 25 months between the first proof-of-concept and being deployed in production. On the other hand, large-scale networks often involving consortia, take more than four and half years to launch.

Future prospects

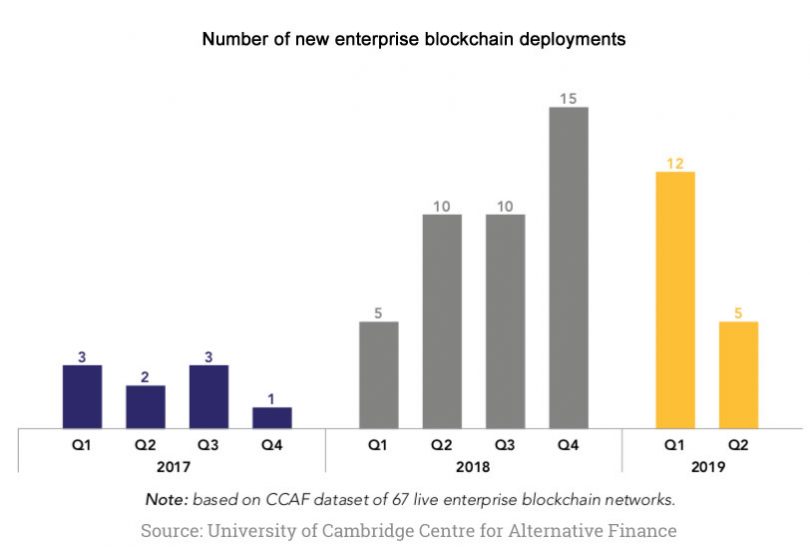

The report notes there are now many more substantial blockchain initiatives, as opposed to the numerous Proofs of Concept of the past.

That’s reflected in budgets as 52% of respondents are planning significant spending increases, and another 26% a smaller rise. Only 4% indicated a cut in the budget allocation.

As the dust settles and a clearer picture of blockchain applications emerges, wider adoption is expected by blockchain vendors. In the private sector, 40% envision broader adoption to take 1-2 years, and 39% anticipate 3-5 years.

“As empirically demonstrated in this report, blockchain adoption by incumbents is indeed a slow and challenging process that requires deep cross-organizational coordination and careful legal and organizational design choices,” CCAF’s Wardrop concludes.

Below are other recent blockchain surveys:

Accenture: blockchain for aerospace

Boston Consulting Group: blockchain for transport and logistics

Cap Gemini blockchain survey

Deloitte 2019 blockchain survey

Deloitte 2018 blockchain survey

EY blockchain (finance and tech professionals) survey

EY fintech adoption survey

EY APAC blockchain survey

IDC semi-annual enterprise blockchain forecast

IHS Markit survey

KPMG technology industry innovation survey

PwC blockchain survey

PwC China blockchain survey

World Energy Council / PwC blockchain survey

SAP blockchain survey

TD Bank payments industry survey

BNY Mellon payments survey

Friss insurance survey

Juniper enterprise blockchain survey

BIS Central Bank Digital Currency survey

IBM / OMFIF Central Bank Digital Currency survey

ING general population cryptocurrency attitudes