Today Digital Asset announced the results of a pilot with 45 institutions who simulated the use of 22 different DLT applications on the Canton Network. The network launched last July and aims to provide DLT interoperability to address the silos being created by numerous institutional permissioned blockchains.

With public blockchains and the first enterprise blockchains, the idea was to have extensive networks where industry participants could share data, trade and settle transactions. Instead, today there are a large number of permissioned blockchain networks, pretty much one for every application. Given there are so many of them operating as islands, only a few have gained traction.

Individually connecting networks through bridges or other means is relatively costly. Plus, it risks recreating many of the maintenance issues that exist in the current infrastructure.

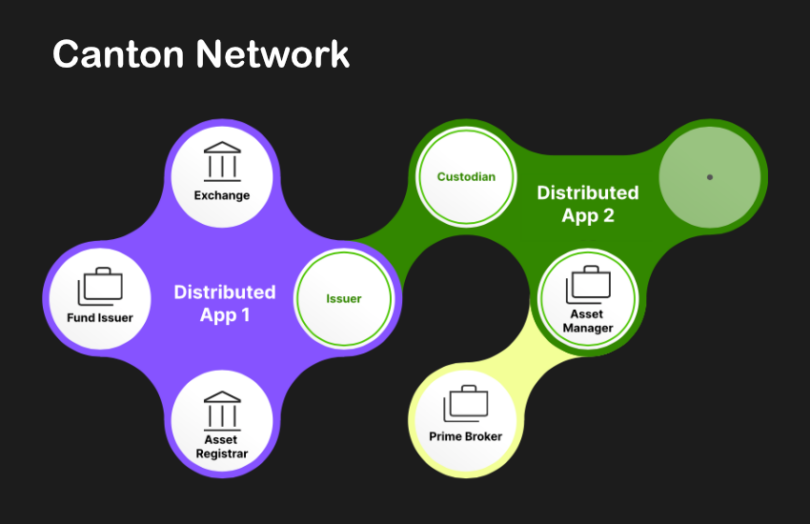

What’s needed is the ability to transact across networks. For example, using a tokenized asset on one network as collateral for a transaction on another. Or enabling tokenized cash on one network to atomically settle a tokenized asset transfer on another.

The Canton Network provides that connectivity. However, it only supports applications using Digital Asset’s DAML smart contract language and the Canton blockchain.

“Canton allows previously siloed financial systems to connect and synchronize in previously impossible ways while abiding by the current regulatory guardrails,” said Yuval Rooz, CEO and Co-Founder of Digital Asset.

We covered the network functionality in more depth last year.

The Canton Network pilot

The recent simulations late last year involved 22 applications on the Canton Testnet and a variety of institutions. They included asset managers, banks, custodians, exchanges and one financial market infrastructure. A list of institutions is provided at the end. The instruments involved in the simulations were tokenized securities, money market funds and cash.

“Canton gives the market a chance to reimagine this infrastructure from zero, making it more efficient, predictable, and operationally reliable,” said Chris Zuehlke, Global Head of Cumberland & Partner at DRW. “The ability to have DvP through the Canton Network will create certainty of settlement allowing us to think about counterparty risk differently.”

The applications included in the trial related to registries for funds, bonds and cash as well as margin management and trading.

Several participants already have production applications. They included BNY Mellon, Broadridge, DRW, EquiLend, Goldman Sachs, Oliver Wyman, and Paxos. Other participants were abrdn, Baymarkets, BNP Paribas, BOK Financial, Cboe Global Markets, Commerzbank, DTCC, Fiùtur, Generali Investments, Harvest Fund Management, IEX, Nomura, Northern Trust, Pirum, Standard Chartered, State Street, Visa, and Wellington Management, with Deloitte acting as an observer, and Microsoft as a supporting partner.