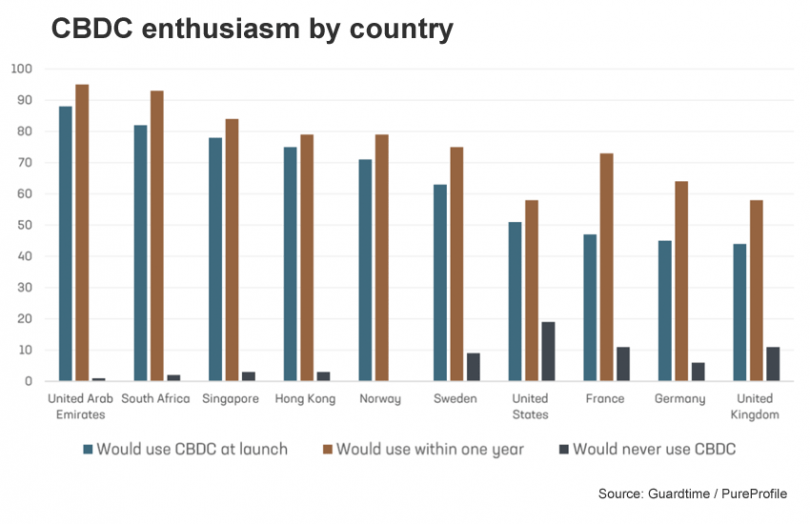

The Estonian blockchain company Guardtime has recently published a survey on consumer attitudes towards a central bank digital currency (CBDC). Across ten countries it found that 64% of consumers would be likely to use a digital currency at launch. Compared to other countries, the U.S. was more reticent, with almost 20% of respondents saying they would never use a CBDC.

Until now, limited research has been conducted globally into whether consumers are ready and enthusiastic for a CBDC, despite a BIS survey finding that 86% of central banks are actively researching the potential for a digital currency. Apart from think tank OMFIF’s early 2020 report that involved IPSOS/Mori questioning more than 13,000 people, Guardtime’s survey is one of the first global consumer studies in this area. PureProfile questioned over 900 people in July 2021.

The survey found a “broad, global willingness to use a digital currency”. Across four use cases, around 70% of people said they would adopt a CBDC within a year, with slightly more enthusiasm for using a CBDC for payment as opposed to switching away from cash savings or accepting a salary in CBDC.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.