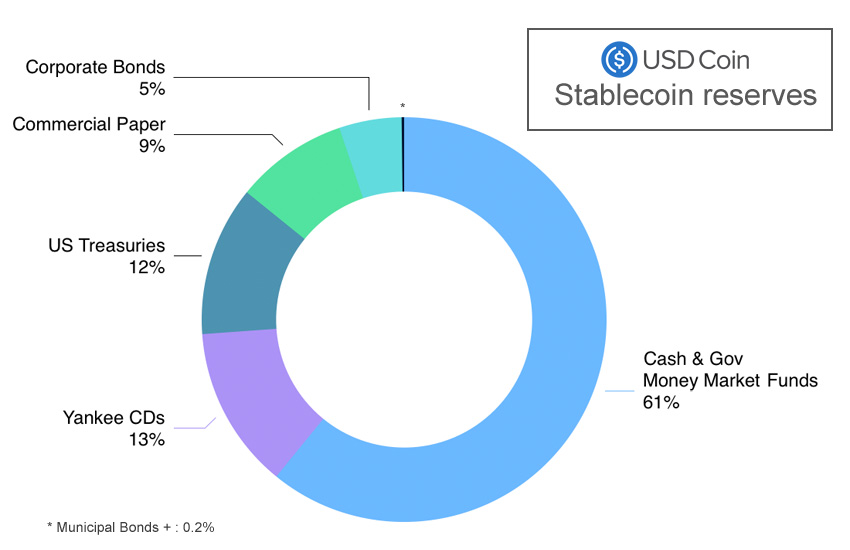

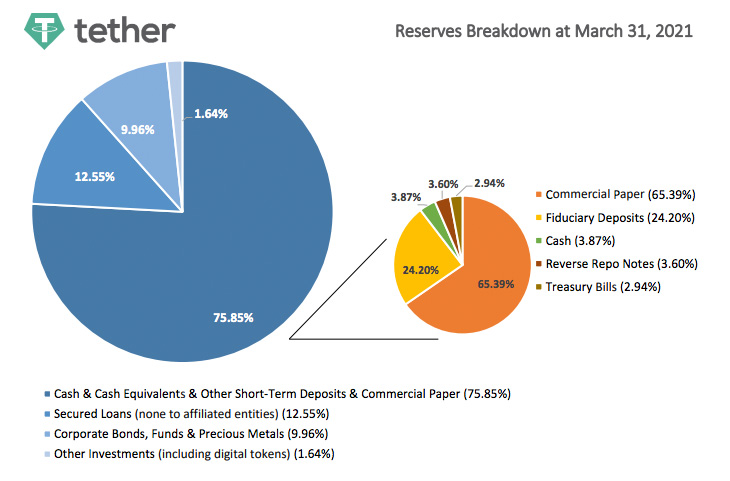

Yesterday, Circle the administrator of the USDC stablecoin (market cap $27 billion), shared details about the assets that underpin the digital currency as the company prepares to list via a SPAC. The degree of transparency and quality of assets is significantly superior compared to the Tether stablecoin (market cap $62 billion), where the asset backing raised concerns at the Boston Federal Reserve and Fitch. But there have always been significant questions around Tether.

In a crisis, there’s a strong chance that Circle would be able to meet significant USDC redemptions, if not instantly, then within a pretty short timeframe. Putting it another way, if regulators bring in rules about the quality of assets that need to back stablecoins, it’s likely that USDC assets would easily comply. And that can’t be said for Tether by a wide margin.

When the Boston Fed voiced concerns about stablecoins, it compared them to money market funds that have required interventions during the last two crises. While Circle holds 61% of funds in cash and government money market funds, these are not the sort of money market funds that have caused issues. For example, during the March 2020 money market liquidity crisis, prime money market funds experienced mass redemptions and these are not invested in treasuries.

However, even though the USDC assets couldn’t be a whole lot safer, it doesn’t mean to say they are without risk. During the early stages of the COVID crisis, the U.S. treasury market also experienced mass liquidations. That required the Federal Reserve to purchase $1.6 trillion in treasuries between March and June 2020.

A strong feature of the Circle transparency report is the detail it shared about both ratings and maturities for each asset class.

Circle’s announcement stated, “we want to continue leading the sector with greater transparency and a deeply committed model of public-private collaboration, especially as the role of dollar digital currencies grows in importance in the global financial system.”

In contrast, the mix of Tether’s assets are vastly inferior quality-wise, and the details about quality were lacking, leading to the assumption that the assets are relatively risky.

Some have noted that top five accountant Grant Thornton audits the USDC assets, whereas Tether’s are audited by the tiny Moore Cayman. However, Moore Cayman is part of Moore Global which ranks number ten in the world as an accounting firm. The asset breakdown was published by Tether itself, not Moore, and the document was completely separate from the audit report. That might explain the lack of detail but also reduces its credibility.

USDC’s breakdown accompanies the Grant Thornton audit report, but the auditor’s opinion explicitly does not cover any details other than the gross amount of assets.

The G20 and regulators around the world are increasingly focused on stablecoins as digital currencies become more popular. Europe has plans to regulate stablecoins as e-money and we recently compared the two. We also highlighted how digital currencies such as stablecoins and central bank digital currencies are likely to make the monetary system more fragile.