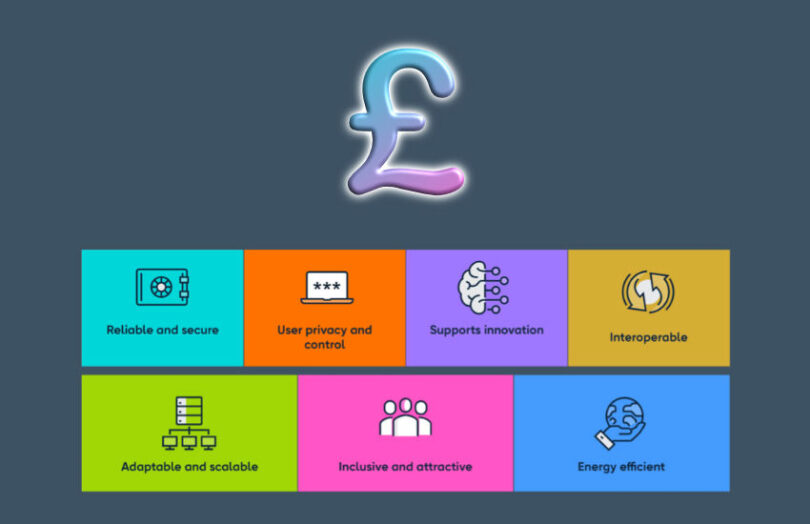

Today the Bank of England and HM Treasury shared the results of its digital pound consultation launched in February last year. It received 50,000 responses, with respondents raising the usual central bank digital currency (CBDC) concerns around privacy. While no decision has been made, the UK has committed to tabling legislation before launching a CBDC. It also confirmed that the design phase started in 2023 based on the principles outlined in the diagram above.

The Bank and HM Treasury plan to share more details regarding the design phase approach later this year. This phase will continue until at least 2025 when a decision is needed on whether to proceed to the build phase. After that, a build phase would include prototypes and pilots before a launch decision.

Neither the government nor the central bank will have access to personal payment details. Legislation would guarantee user’s privacy, and the Bank will explore technologies to prevent it from accessing personal data. However, both institutions acknowledged that public concerns remain.

Additionally, wallet solutions will be developed by the private sector, supporting innovation. And there will be no government-initiated programmability. That means the private sector can add additional functionality.

Digital pound holding limits

One of the hot topics was holding limits. The UK proposed comparatively high individual CBDC holding limits of £10,000 – £20,000. Companies would be allowed to hold more. In the consultation responses, banks preferred limits in the £3,000 – £5,000 range to limit deposit outflows. This is consistent with protestations from industry body UK Finance. Building societies would be particularly impacted because, by law, they cannot have a wholesale funding ratio above 50%. Unsurprisingly, fintech payment providers preferred no limits at all.

The views regarding corporate holdings varied considerably. Banks are likely less concerned because the CBDC will not provide interest. Hence, corporates are likely to keep most of their cash at banks or elsewhere.