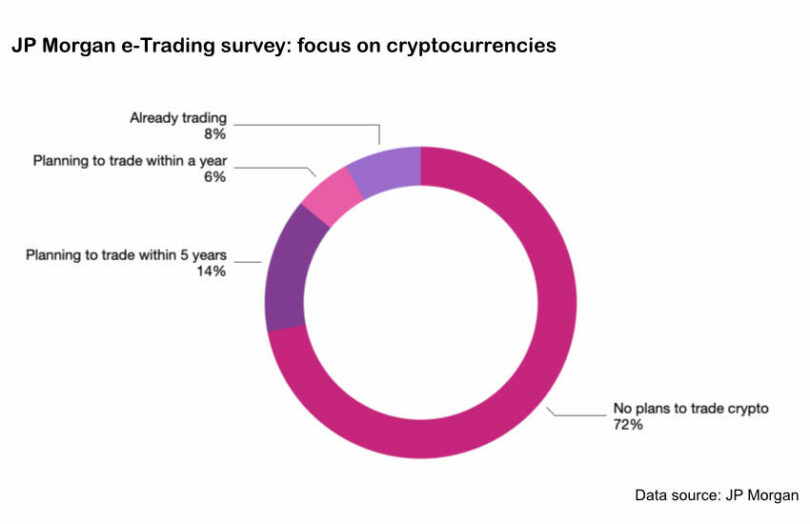

JP Morgan released its latest e-Trading survey results of 835 institutional traders. The survey covered fixed income, currency and commodity traders and found that 72% have no plans to trade cryptocurrencies. Around eight percent are already trading, and the remaining 20% plan to start trading within the next five years.

The survey also asked which technologies would be the most influential in the next three years. Last year’s survey ranked AI and blockchain/DLT as neck and neck at 25% each (after mobile trading apps). In contrast, AI has streaked ahead this year at 53%, with blockchain/DLT a distant third at 12%.

JP Morgan’s CEO Jamie Dimon has been a crypto critic for years. He reiterated his criticism last month, saying, “Bitcoin is a hyped up fraud, a pet rock.” However, he is a supporter of blockchain technology and the bank has its Onyx division focusing on digital assets and payments.

Onyx has its JPM Coin solution for blockchain-based deposits and Liink for banks to share compliance and other data about cross border payments. It has a blockchain-based repo platform and another for collateral settlement. The bank is experimenting with DeFi technologies such as automated market making (AMM). And it’s an investor in multi-currency payment solution Partior.

Meanwhile, last year Fidelity Digital Assets surveyed institutional investors and found a massive disparity in crypto adoption based on the type of investor. Few traditional hedge funds, endowments and pension funds had dipped their toe in the water – the figure was five to seven percent. In contrast, 82% of high-net-worth individuals had invested, and 87% of crypto hedge funds or venture capital firms.