Today KPMG released its Pulse of Fintech report. Investment in US-based fintech companies reached $14.2 billion in the first half of 2018 over 427 deals. $5 billion of that came from venture capital.

In Europe investment reached $26 billion across 198 deals in the first half of 2018. But these figures include the acquisitions of Worldpay ($12.9bn) and iZettle($2.2bn) and buyouts of Nets ($5.5bn) and IRIS ($1.8bn). The UK accounted for $16 billion of the figure.

In Asia, the figure reached $16.8 billion across 162 deals, though Ant Financial accounted for $14 billion alone.

Blockchain

VC blockchain investment doubled compared to 2017. So far this year VCs have invested $858m compared to $631m in the whole of 2017.

The increase is even more pronounced because the 2017 figure includes a $100 million plus round for R3.

“There’s more VC flow available than opportunities to invest – a sign of tremendous growth in the space,” said Safwan Zaheer, Financial Services Digital & U.S. Fintech lead for KPMG LLP. “Blockchain has the potential to transform banking services. If banking systems were to be rewritten today they would be based on blockchain.”

The report also states that ” While it [blockchain] has primarily been looked at from a banking and insurance point of view to date, the reality is blockchain opportunities abound and could enhance processes for any number of US and global businesses.”

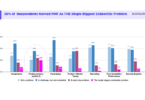

Blockchain project mentions

“Southeast Asia is becoming very significant for the development of blockchain. The cultural ecosystem, economy, and many governments are focused on driving blockchain development,” said Eamonn Maguire KPMG”s Global Lead of Blockchain.

“This holistic innovation effort is also evident in the Middle East, where governments are playing a significant role in innovating and stimulating their economies through the economic development associated with technology. In other regions, government adopts a more neutral approach where innovation is driven directly by the commercial sector.”

The report highlighted the Australian Stock Exchange project plus Tencent’s WeBank syndicated loan platform in China.

Ireland’s Gecko Governance, which offers a blockchain-based solution to manage compliance raised a $1m seed round and is now planning an ICO.

KPMG classified US-based Harbor as a regtech. The blockchain-based platform that tokenizes private securities for trading raised $38 million in two funding rounds. In May Paxos announced a $65m Series B round. The company reduces settlement risks.

Basis which aims to have an algorithmically stable cryptocurrency announced a $133m private placement in April.

Ireland based Circle raised $110m in a Series E round in May, some of that came from China-based Bitmain.

French company Ledger raised $77m for its hardware wallet.