Last week McKinsey published an article titled “Blockchain’s Occam problem“. The authors point to the lack of large-scale production examples of blockchain despite billions of investment and assert that to succeed blockchain needs to be the simplest solution to a business problem.

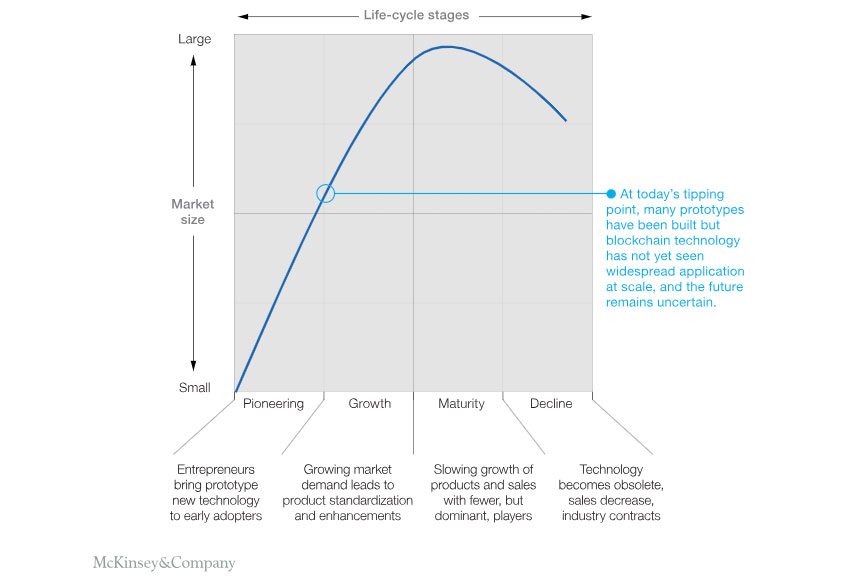

The consulting company outlines the four-stage evolution of technologies from pioneering to growth, then maturity and decline. It pins blockchain as on the cusp of transitioning from pioneering to growth but says most projects are still at proof of concept stage or being wound down though it did not provide statistics.

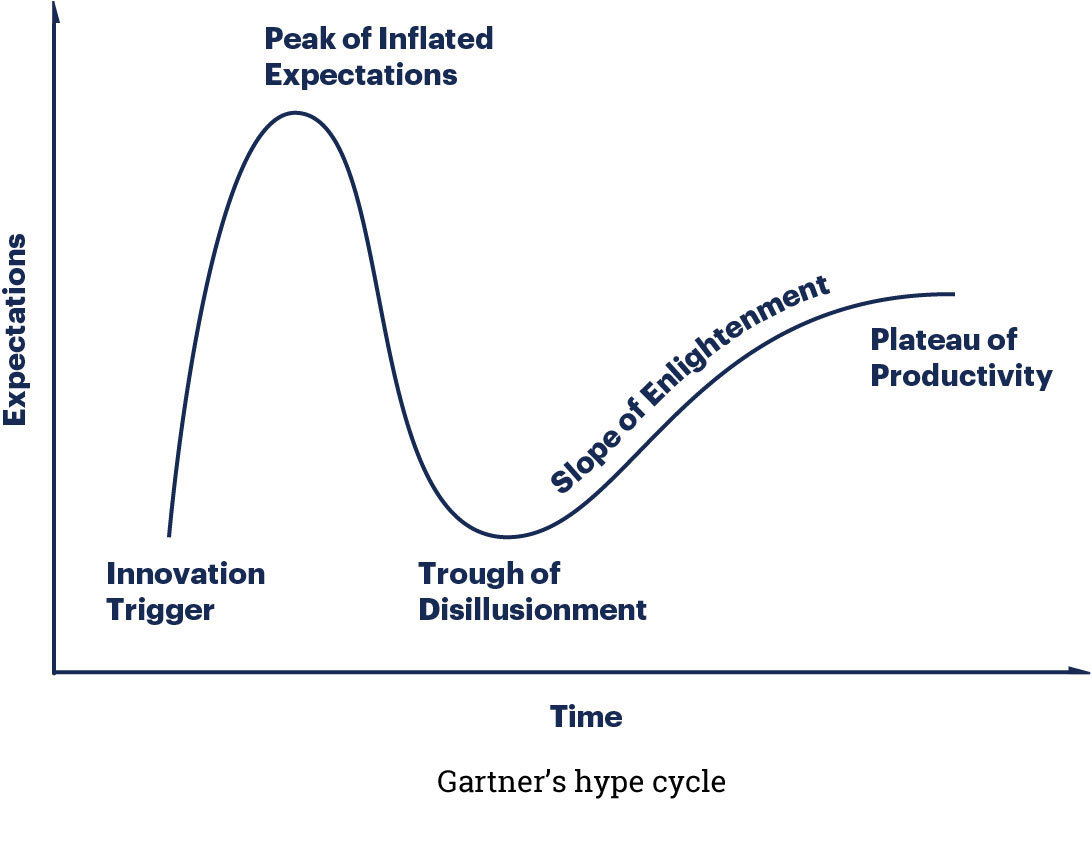

Ledger Insights notes that McKinsey’s smooth life-cycle approach contrasts with Gartner’s hype cycle which sees a trough of disillusionment following the peak of expectations before a pickup until productivity is achieved. But not every technology makes it out of the trough.

McKinsey highlighted the payments sector as a good example because it demonstrates that blockchain has to compete with other technologies. It noted that $12 billion was invested in fintech last year of which 60% was in payments and lending. Several technologies are in play, and SWIFT’s own GPI is a serious competitor to many blockchain solutions.

Additional issues include the innovator’s dilemma of investing in self-disruption and the requirement of a dedicated network with the cost of setting up secure servers.

“Blockchain players in the payments segment, such as Ripple, are increasingly partnering with nonbank payments providers, the businesses of which may be a better fit for blockchain technology. These companies may also be willing to move forward more rapidly with integration,” says McKinsey. Indeed in the last few weeks, Ripple has announced deals with multiple remittance companies.

The consultant notes that over the past two years, the financial services leaders they are working with have begun to have doubts. And it sees the sector as relatively early adopters compared to others.

McKinsey continued: “By late 2017, many people working at financial companies felt blockchain technology was either too immature, not ready for enterprise level application, or was unnecessary.” Most would agree with the immaturity of all blockchain technologies a year ago.

What McKinsey doesn’t mention, is that those working with earlier versions of blockchain and other technologies always struggle more and twelve months on enterprise blockchain technologies are far more mature, even if the technology is still nascent.

Practical value

The McKinsey article highlights three potential areas where blockchain could have practical value in 2019.

The first group is niche applications where blockchain is particularly well-suited such as tracking asset ownership and status.

Secondly for “modernization value” for digitization, simplification and collaboration, though blockchain will often be a small element. It provides examples of shipping, trade finance and payments.

The third group is “reputational value” where companies want to show their ability to innovate, where McKinsey says there is “little or no intention of creating a commercial-scale application.”

The consultant says blockchain is a poorly understood clunky solution in search of a problem. Additional hurdles include cost pressures, cultural resistance because of job loss fears, concerns over self-disruption of healthy revenues, worries about security, and the challenge of network governance.

Solution

McKinsey concludes by recommending that organizations start with a pain point or problem and blockchain must be the simplest solution. Progress should be measured against concrete objectives and ROI. And companies should commit to adoption, subject to passing various targets along the path to production.