Yesterday MUFG and Progmat announced a collaboration with the existing stablecoin JPYC. Progmat is the tokenization platform founded by Japan’s MUFG and backed by several other institutions. The Progmat-MUFG-JPYC deal is twofold. JPYC will explore an additional stablecoin format and issuing via the Progmat Coin platform. JPYC has applied for a license allowing the exchange of Progmat-issued stablecoins with other offshore stablecoins.

When we think of stablecoins we consider Tether and USDC, which each have tens of billions of market capitalization. However, the largest euro stablecoin issuance is $135 million and the biggest Singapore dollar stablecoin is $25 million. JPYC’s market capitalization is 2.3 billion yen or $15.6 million.

JPYC launched in 2021, long before Japan’s new stablecoin laws came into force in June this year. Hence, JPYC is currently a prepaid payment method, similar to a prepaid card. In fact, it offers JPYC cards that can be used in stores without any conversion necessary.

The key challenge with prepaid cards is refunds aren’t possible. For a stablecoin, that’s not an attractive feature.

New Japanese stablecoin legislation

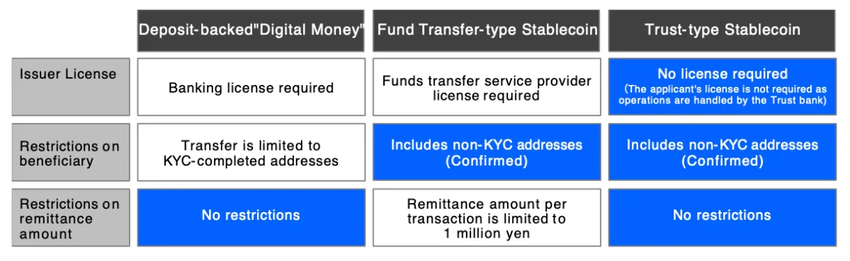

Hence, JPYC plans to comply with the new stablecoin legislation which offers three types of stablecoins: bank issued and backed by deposits; fund transfer type stablecoins, which is the main JPYC plan; and trust-type stablecoins issued via a trust bank.

One disadvantage is the funds transfer type requires a special license that is not necessary for a trust coin. Another downside is this type of stablecoin has transaction limits.

Hence, the plan is to ‘study’ additionally issuing JPYC as a trust type stablecoin. That involves MUFG Trust holding the stablecoin reserves and JPYC issuing the coin via the Progmat Coin platform.

Regarding licenses, for offshore-issued stablecoins to trade in Japan, intermediaries need to have a Japanese Electronic Payment Instrument Exchange Service Provider license. We believe JPYC applied for this license as well but only expects to receive it in mid 2024.

That latter license is of interest to Progmat because it wants to get going with cross border FX whereby yen stablecoins issued via Progmat are exchanged for dollar stablecoins.

Meanwhile, Progmat Coin has numerous stablecoin initiatives on the go. Binance is exploring issuing a Japanese stablecoin via Progmat Coin. It is also exploring an institutional stablecoin with DRW Cumberland and others. And in Japan, Progmat has a National stablecoin initiative with other institutions. On the technology side, with DataChain and TOKI, Progmat created a solution enabling stablecoins to circulate across multiple public blockchains.