In a recent webinar, the Reserve Bank of India’s Deputy Governor T Rabi Sankar spoke about the promise of a digital rupee, confirming that India is currently pursuing a phased strategy for its potential central bank digital currency (CBDC).

“CBDCs is likely to be in the arsenal of every central bank going forward. Setting this up will require careful calibration and a nuanced approach in implementation,” said T Rabi Sankar. “Every idea will have to wait for its time. Perhaps the time for CBDCs is nigh.”

India is among many countries researching CBDCs – 86% of central banks, according to a 2021 BIS survey – but are yet to deploy pilot projects.

The key question present throughout Sankar’s speech was the need for a CBDC. He believes that India’s leading global position in digital payment systems reduces the attractiveness of a digital currency.

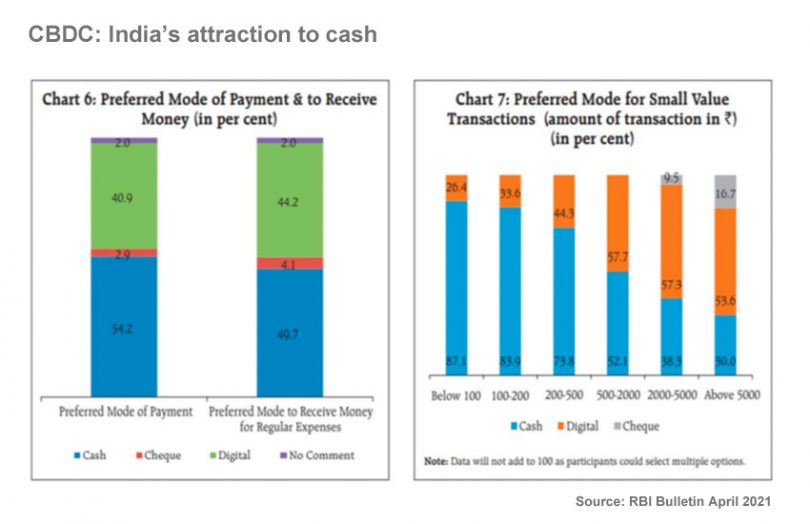

However, a digital rupee would solve India’s high currency to GDP ratio, as it would reduce the substantial cost of printing and distributing cash. Despite the availability of convenient digital payments in India, citizens prefer cash for smaller payments and are attracted to its anonymity.

A CBDC might also help quell concern over stablecoins and virtual currencies, which pose a threat to central bank money, especially if denominated in the U.S. dollar. The need to “retain public preference for the rupee” is essential, Sankar affirmed.

That being said, India’s cautious start to CBDC experimentation can be explained by multiple challenges that concern the central bank, including the potential for a CBDC to accelerate bank runs, the potential for bank disintermediation and reduced effectiveness of monetary policy.

Tackling cybersecurity risks and ensuring payment anonymity are also key areas that will guide the RBI’s approach to CBDC testing.

“There are associated risks, no doubt, but they need to be carefully evaluated against the potential benefits. It would be RBI’s endeavour, as we move forward in the direction of India’s CBDC, to take the necessary steps which would reiterate the leadership position of India in payment systems,” said Sankar.

For now, the RBI will continue to evaluate some of the design issues including the question of retail and/or wholesale, a token or account based system and whether or not to use blockchain or distributed ledger technology (DLT).

Meanwhile, other countries are also joining the conversation. Earlier this month, Estonia shared its CBDC test results, and the Governor of the Central Bank of Ireland gave his thoughts on the promise of a CBDC, saying that it was a question of not “if” but “when”.

Last week, it was also revealed that the Bank of Korea will be advancing its cross-border CBDC trials with participation from Samsung, which will research cross-border payments to other mobile phones or connected bank accounts.