Today Japan’s SBI Holdings

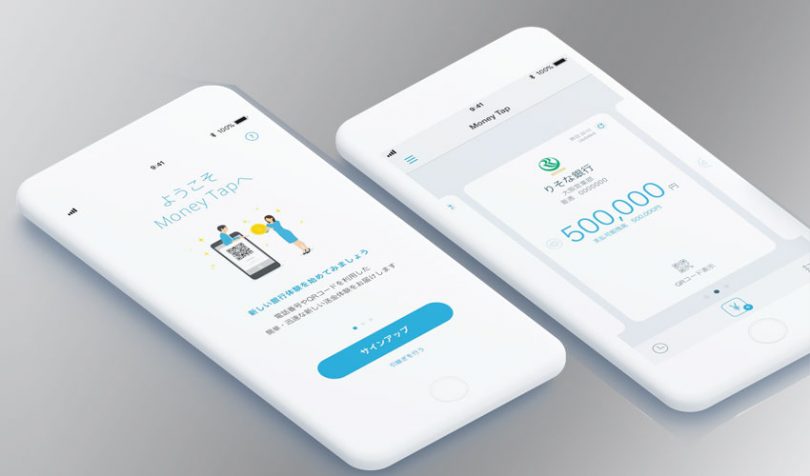

announced that the Money Tap blockchain payments app has incorporated into Money Tap Limited. The app launched in October last year enabling bank to bank payments by scanning a QR code. Previously it involved a consortium of sixty Japanese banks led by SBI Ripple Asia, a joint venture between SBI (60%) and Ripple (40%). By incorporating Money Tap, the aim is to provide new services faster.

According to the

Nikkei Review, the company is initially a 100% SBI subsidiary with the aim of getting investment from banks to be announced shortly. But for now, SBI can provide financing to push the initiative forward.

The

Money Tap app enables both domestic and foreign payments. The advantage for domestic bank payments is they can be made 24/7 rather than just during banking hours which is the current norm in Japan.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.

Image Copyright: SBI Ripple Asia