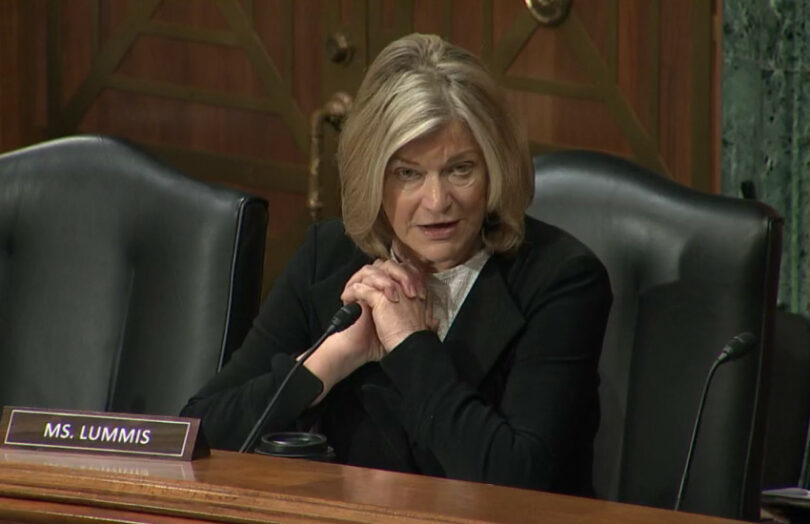

Last month, it appeared Republicans and Democrats in the House had mended fences and were moving towards bipartisan backing for the stablecoin Bill put forward by the House Financial Services Committee. Now, Axios reported that another Bill is circulating, this time from the Senate. Senators Cynthia Lummis (Republican) and Kirsten Gillibrand are reported to be finalizing a stablecoin Bill.

During 2022 the two Senators put forward comprehensive digital assets legislation, with stablecoins forming an important chunk of that Responsible Financial Innovation Bill. Axios sources said Senators received input from the New York Department of Financial Services, the Federal Reserve, Treasury and the National Economic Council for the latest draft legislation. It’s discussing the Bill with the House Financial Services Committee.

Last year Republicans voted in favor of the House Financial Services Committee stablecoin Bill. However, there was significant animosity from Democrats during the debate. Politico reported last month that changes have been made to the draft Bill and that the House was close to bipartisan agreement. Federal Reserve Chair acknowledged as much in a hearing last month.

Hence, news of a separate Bill is surprising. That said, Lummis and Gillibrand have already demonstrated a solid ability to work across party lines. While Senator Lummis is just as firm on issues as any other Republican, she’s less combative with regulators. That might make it easier to get helpful input and achieve consensus.

Urgency of stablecoin legislation

The market capitalization of the largest two stablecoins has grown from $114 billion to $129 billion during the past three months. With Bitcoin ETFs driving the new crypto boom, the need for legislation is becoming more urgent.

Meanwhile, a CFTC advisory group proposed a digital asset taxonomy. Under the taxonomy, Tether the largest stablecoin, with a market capitalization of more than $100 billion, does not classify as a stablecoin. That’s because some of its backing assets are a bit risky, potentially undermining future price stability.