The SIX Digital Exchange (SDX) is having discussions with Invest Direct, a Swiss startup that provides due diligence and matchmaking services for private companies. SDX is the blockchain-based exchange and central securities depository (CSD).

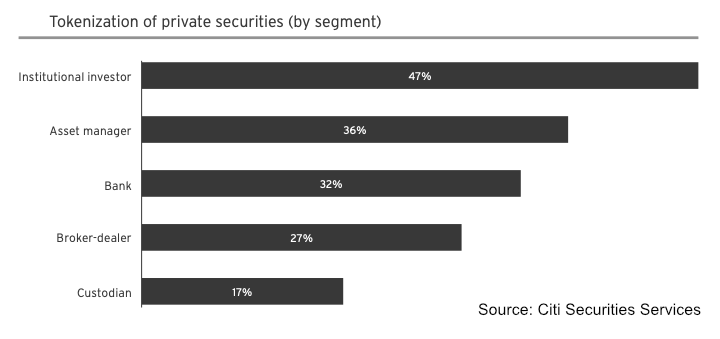

When capital markets experts discuss tokenization, private equity is seen as one of the most promising sectors. That’s in part because an increasing number of so-called unicorns are remaining private but are attractive to investors. A recent Citi survey found that 47% of institutional investors are looking to DLT to remove private equity frictions.

“This planned collaboration highlights the strengths of both Swiss entities, catering to surging demand for streamlined processes and standardised practices within the private equity landscape,” said David Newns, Head of the SIX Digital Exchange. “It enables a more accessible and transparent platform for financial institutions, issuers, and professional and institutional investors to engage in private placements with enhanced confidence.”

Meanwhile, SDX recently signed its sixth bank as a member of its DLT-based CSD bringing the total membership to eight. At a recent event, one of SDX’s executives suggested the figure could grow to 20 before year’s end. Soon SDX will use a live wholesale CBDC Swiss Franc for transactions for a limited period. This might be driving interest.

To gain traction the exchange is exploring a wide range of options to reduce frictions. Members don’t have to operate DLT nodes but instead interact using Swift APIs. The DLT-based CSD is linked to the main SIX SIS CSD enabling conventional investors to buy digital securities, as happened with last year’s UBS bond.

It also has a joint venture with Japan’s SBI in Singapore, AsiaNext, to enable interoperability across jurisdictions. And it recently participated in a Swift tokenization trial exploring interoperability with both legacy systems and multiple public blockchains.