A digital assets survey of 300 institutional investors found that DeFi was rated as the biggest potential blockchain disruptor. The survey was conducted last October by State Street Digital and Oxford Economics, with the results published recently.

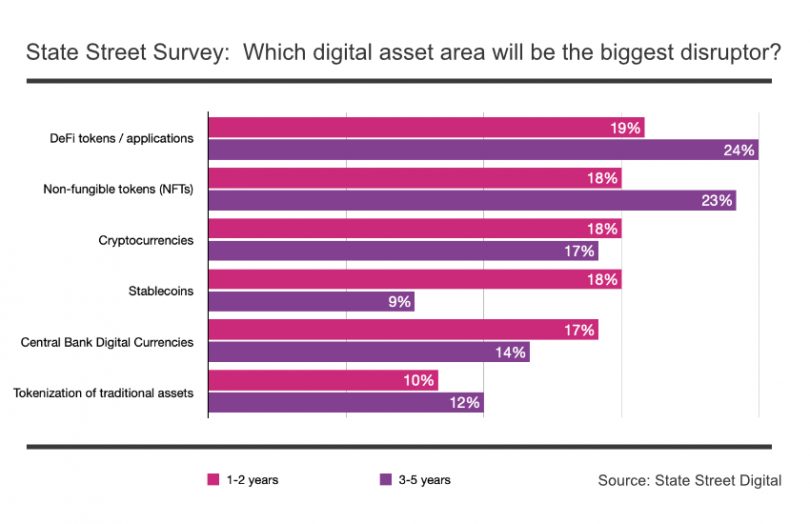

Looking at the one to two-year timeframe, investors rated five potential blockchain disruptors almost equally, leading with DeFi applications and NFTs followed by cryptocurrencies, stablecoins and CBDCs.

The tokenization of traditional assets – such as stocks, bonds and real estate – came a distant last, despite often being viewed as a key blockchain application for incumbents. DeFi and NFT are seen as forging ahead on a three to five-year timescale.

However, larger asset managers with more than $500 billion assets under management have slightly different views. Compared to their colleagues, they are far more bullish on both cryptocurrencies and the tokenization of traditional assets.

Some of these views could be the benefit of hindsight. People often struggle to envisage innovations, never mind their adoption. Had this survey been conducted 18 months earlier, we’d guess that the NFT and DeFi predictions would have been close to zero percent.

Survey respondents viewed the leading benefits of tokenizing traditional assets as increased transparency, improved risk management, and increased liquidity. Fifty percent (or a little more) of respondents chose each of these factors, whereas efficiencies came a distant fifth at 25%.

More generally, blockchain is envisaged by the majority (52%) as the primary tool that will enable real-time settlement. Thirty-one percent foresee existing technology used for instant payment, and 17% don’t believe faster settlement is necessary.

Crypto adoption

A major part of the survey was about cryptocurrency adoption. Looking to the next twelve months, 14% of respondents said they plan to invest in digital assets for the first time, with 51% intending to increase investment a little and 19% expecting to substantially increase their digital asset allocation. On the two to five-year time scale, 81% plan to increase their digital assets investment, with slightly less than half that figure planning a significant increase.

One of the survey’s findings was that most investors don’t have deep knowledge of the digital assets sector, with only around 5% rating themselves as experts on a range of cryptocurrency topics. But they also weren’t entirely ignorant. Depending on the subject, 60-70% of the respondents rated themselves as having some to moderate knowledge.

While cybersecurity and transparency are seen as key risks with cryptocurrencies, less than half the number of people rate market manipulation and carbon footprint as concerns. However, the sustainability issue is having an impact at a retail level, with a backlash against some NFT projects.