Blockchain trade finance firm

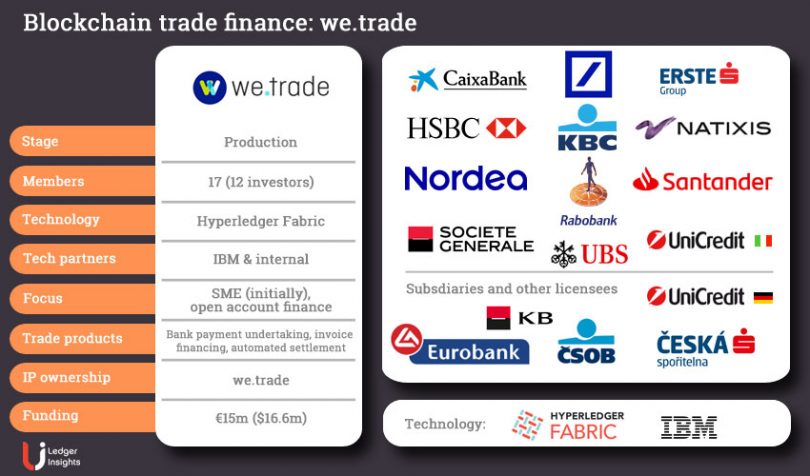

we.trade recently told Ledger Insights that 55% of its transactions are automated payments. The firm is a

joint venture between 12 major banks, including HSBC, Deutsche Bank, Santander, and Société Générale. Although it had a soft launch in 2018, banks started to roll out the service to clients last May, with the most recent CaixaBank launching its offering this month.

Given the primary business model is to offer invoice financing and bank payment undertaking, one could interpret the popularity of auto settlement as unfavorable. But it may be a big win for suppliers, banks and we.trade.

The

trade finance platform tracks the supply chain process. So provided the goods are delivered, payment can be triggered automatically on the contractually agreed date.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.

Image Copyright: Ledger Insights. Logos copyright owned by companies