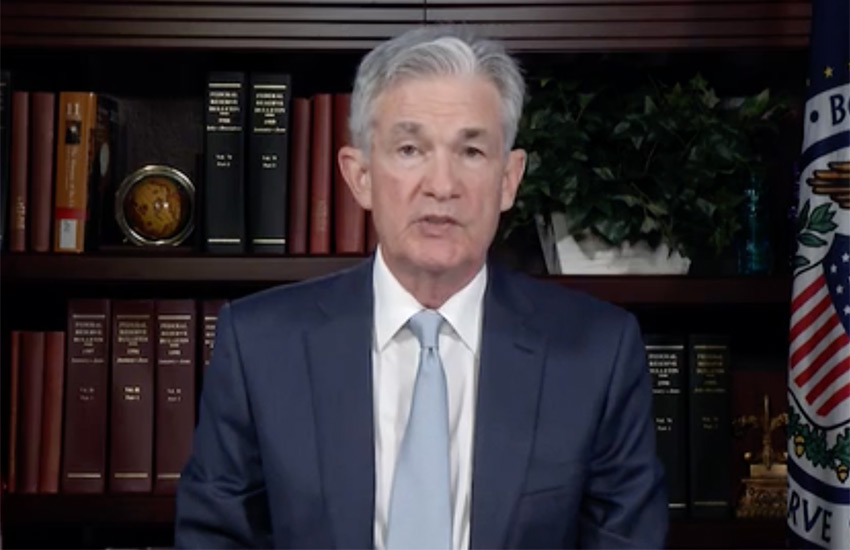

Jerome Powell, Federal Reserve Chair, discussed the need for the approval of Congress for a digital dollar and its timing. He was talking today during a Banque de France conference.

“We will need approval from both the executive branch and Congress to move ahead with a digital currency,” he said. “So we see this as a process of at least a couple of years where we’re doing work, building public confidence in our analysis, in our ultimate conclusions, which we certainly haven’t reached yet.” This could be interpreted as a decision on a central bank digital currency (CBDC) coming in two years.

That makes sense because he mentioned that the FedNow instant payment system is expected to come online in around a year, which seems a little later than May to July timeframe previously mentioned. An additional year will allow time to assess the impact of FedNow on a CBDC decision.

Congressional digital dollar approval

Powell’s wording on approval from Congress might receive some attention.

During a U.S. House Committee on Financial Services hearing in May, Federal Reserve Vice Chair Lael Brainard was repeatedly asked whether the Fed would proceed with a CBDC without legislation. At the time, she referred to a January Fed Reserve CBDC working paper that states, “The Federal Reserve does not intend to proceed with the issuance of a CBDC without clear support from the executive branch and from Congress, ideally in the form of a specific authorizing law.” Republicans interpreted the use of “ideally” and “intend” as caveats.

Powell’s comments appear more definitive.

Legislation and self-hosted wallets

The Federal Reserve Chair also discussed crypto-asset and stablecoin legislation. He spoke about the opportunities and risks of crypto-assets, pointing to novelties such as replacing intermediaries with smart contracts and decentralized governance.

He said crypto-assets present new risks, outlining several and stating, “especially unhosted wallets which allows users to custody their own crypto-assets. However, they can also be used to evade sanctions or engage in money laundering.”

While OFAC is entirely separate from the Federal Reserve, OFAC recently shut down the Tornado Cash cryptocurrency mixer citing sanctions and anti money laundering breaches. So this is not a good sign for self-hosted wallets.

In February, Representative Warren Davidson introduced a Bill, the Keep Your Coins Act which aims to protect self-hosted wallets.

At a big picture level, physical cash today allows anonymous transactions. In contrast, future central bank digital currencies may allow levels of privacy but will not allow anonymity. Powell confirmed that today.

It might take time for physical cash to disappear, but as it does, we will lose the right to anonymity over money unless self custody of digital assets is allowed. For some, anonymity is a personal preference. For others, it is survival as it prevents government control and economic exclusion in the case of less benevolent rulers.