Phil Spencer, EVP of gaming at Microsoft, told Axios he’s monitoring the use of non-fungible tokens for games but has some concerns.

“What I’d say today on NFT, all up, is I think there’s a lot of speculation and experimentation that’s happening and that some of the creative that I see today feels more exploitive than about entertainment,” said Spencer.

He qualified his statement by saying not every game is exploitive, and people are figuring things out.

A handful of big NFT games (by market capitalization) has attracted many copycats. The Axie Infinity token has a market capitalization of $8.8 billion, Decentraland’s crypto is worth $4.3 billion, and The Sandbox $2.9 billion. In the latter case, it was worth around $750 million through late October. The price spiked before and after the announcement of a $93 million funding led by Softbank.

The incumbent gaming community is divided about NFTs. For example, Steam banned blockchain and NFT games. But the level of interest must make others concerned about being left behind.

GameIndustry.biz penned an editorial in March saying it wouldn’t write about NFTs unless it was an incumbent. It followed up with another piece last week calling NFT hype ‘baseless’ but saying play-to-earn is worth watching.

“In the middle of some vague handwaving about the future, both (EA’s) Wilson and Ubisoft’s Guillemot attached NFTs to the notion of “play-to-earn” as an important emerging business model,” wrote the games publication. “(Take Two’s) Zelnick, more circumspect, pinned the concept instead to digital collectible items.” The editorial went on to say that the steps being taken are not significant strategic moves and implied they are targeted at investors.

There’s no question there’s a significant amount of hype in the sector as well as risk of exploitation. But we think GamesIndustry is missing a few critical points.

As we previously reported, we sincerely doubt that EA’s approach will be superficial as they have a huge amount to lose. Of its March 2021 net revenues, $1.6 billion or 29% came from the Ultimate Team mode for sports. That enables game players to build a team, which is precisely the functionality of many NFT applications. Plus, in mid October, FIFA implied it was likely to drop EA.

But there’s more. The NFT and gaming startups have deep pockets and hence are perhaps capable of outbidding the likes of EA. With many sports leagues struggling from the pandemic, money talks.

A good example is how Topps, which published MLB collectible cards for 70 years, was dropped in favor of Fanatics. And similarly, the NBA and NFL players union also switched to Fanatics.

Turning to Ubisoft, which has taken small-scale concrete blockchain steps, it’s been monitoring the industry for years and has done more than launch a Belgian blockchain fantasy game. For example, it joined the Tezos blockchain as a corporate baker and invested in Animoca. Admittedly none of that is a core strategic move.

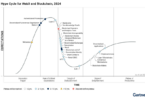

Bringing in player protections and filtering out scams is sorely needed for NFTS. Some kind of “NFT winter” at some point is inevitable. But games businesses that write off NFTs as a fad do so at their peril.