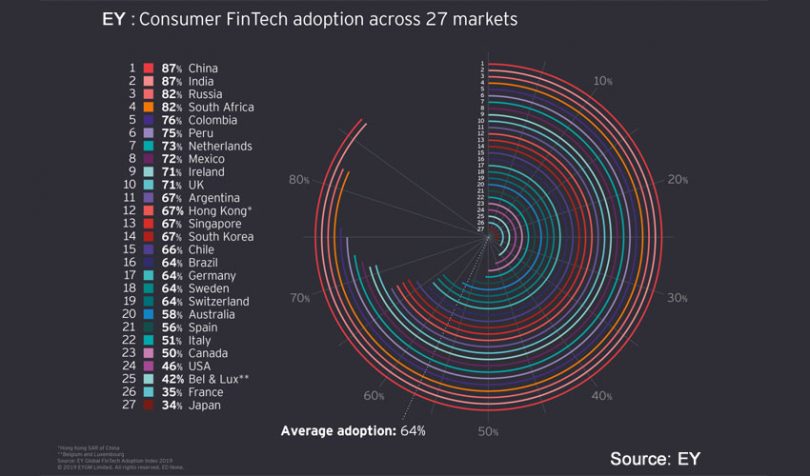

This week EY published its fintech consumer adoption trends survey. There are significant regional variations with BRICS countries taking the top four spots. Chinese and Indian users have the strongest appetite for fintech at 87% adoption each. Russia and South Africa took third and fourth spots at 82%, and Brazil was only sixteenth with a rate of 64%.

The U.S. trailed in at 24th out of 27 countries with 46% adoption, one spot behind Canada. The global average is 64% according to the survey of 27,000 people.

This week the SEC announced it is suing Kik over the messaging company’s $100 million ICO. There’s been a backlash with some saying the SEC is being heavy-handed and will push cryptocurrency business to Asia. But EY’s statistics show that already consumer demand for fintech is higher outside of the U.S.

Separately, EY surveyed 1,000 SMEs in five countries. The adoption rates were significantly lower at an average of 25%, and the U.S. faired a little better. The regional variations in appetite were quite different compared to consumers. China was still top with 61%, but the U.S. was a distant second with 23%, followed by the U.K. (18%), South Africa (16%) and Mexico (11%).

SME fintech adopters are willing to share their data. The appetite for disclosure depends on with whom they’re sharing: 89% are eager to share with a fintech, 70% with other financial services companies and 63% with non-financial services companies. This is good news for companies targeting SMEs for trade finance. These include TradeShift, we.trade, Centrifuge and the International Chamber of Commerce.

Key consumer fintech findings:

- the most used service was money transfers or payments with 75% global penetration, 95% in China

- trust in incumbents is high. 22% of non-adopters said it was due to trusting traditional providers. But this may be an indication of late adopters or laggards

- 68% are willing to consider a financial offer from a non-financial company

- 48% of adopters are willing to share bank information with organizations to receive better offers.

- 60% of consumers prefer to access services through a single platform

- for customer service only 27% prefer to talk to a bank via social media versus face-to-face

- competitive rates is the number one selection criteria and the top priority for 27%. Apparently, ease of use is now taken for granted

Below are recent blockchain surveys:

Accenture: blockchain for aerospace

Boston Consulting Group: blockchain for transport and logistics

Cap Gemini blockchain survey

Deloitte 2019 blockchain survey

Deloitte 2018 blockchain survey

EY blockchain (finance and tech professionals) survey

KPMG technology industry innovation survey

PwC blockchain survey

PwC China blockchain survey

World Energy Council / PwC blockchain survey

SAP blockchain survey

TD Bank payments industry survey

BNY Mellon payments survey

Friss insurance survey

Juniper enterprise blockchain survey

BIS Central Bank Digital Currency survey

IBM / OMFIF Central Bank Digital Currency survey

ING general population cryptocurrency attitudes